Africa's startup landscape

These are exciting times for entrepreneurship on the African continent. With a youthful population, rapidly growing consumer markets, and some rather unique problems to solve, it’s no surprise that the startup growth curve is beginning to steepen.

According to the World Economic Forum, Africa’s average annual GDP growth has consistently outpaced the global average, and is expected to hover around 6% until 2023. Technology is increasingly becoming a key driver of economic growth across the continent.

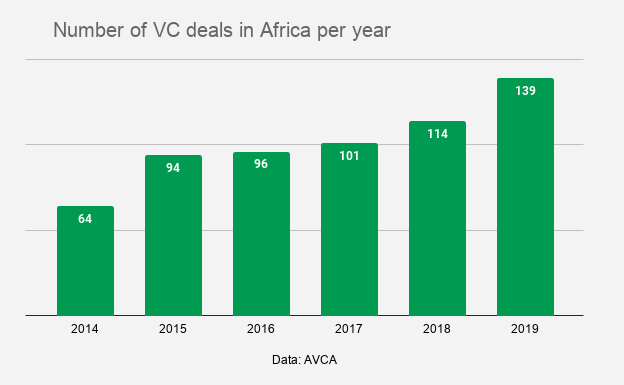

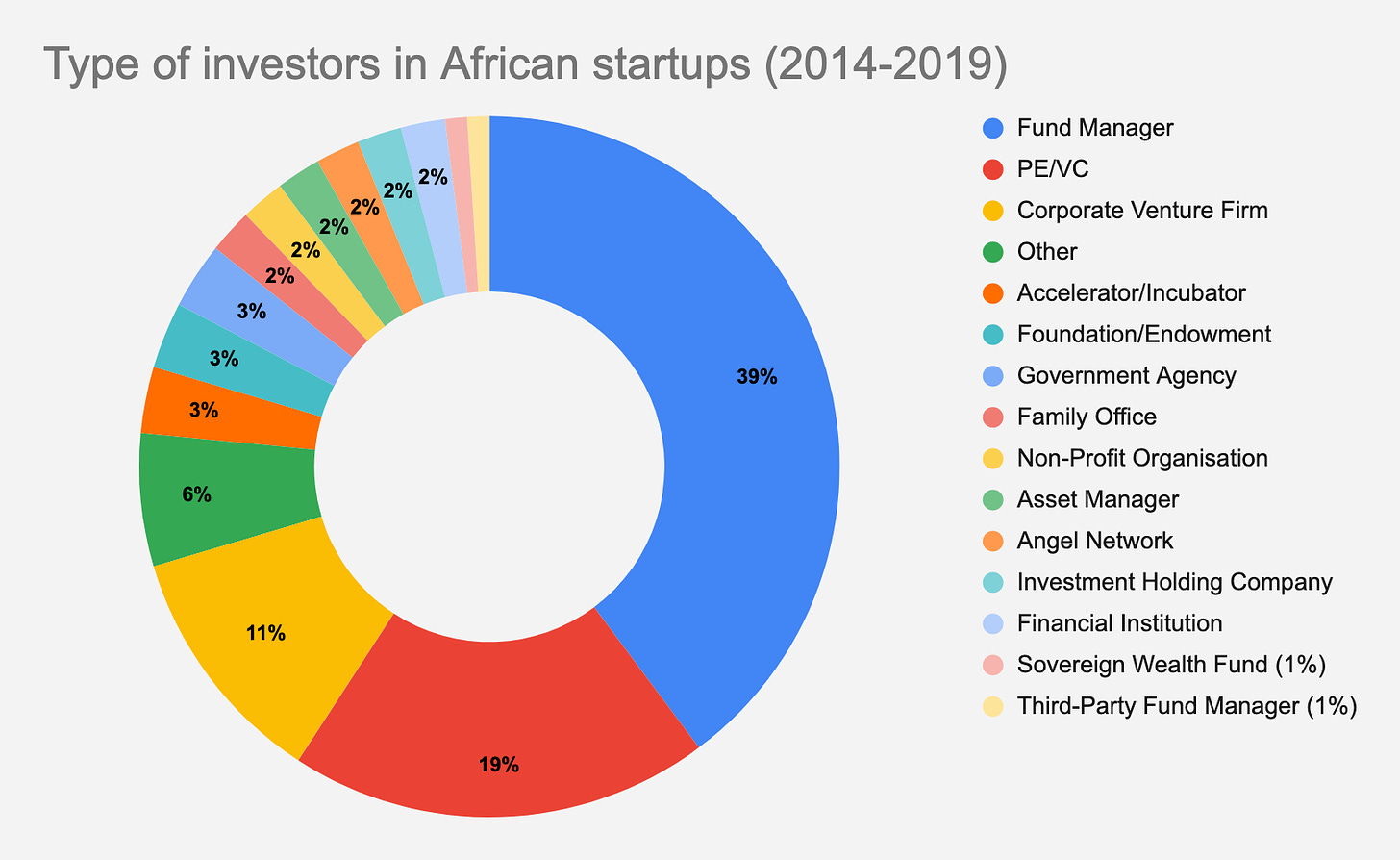

As a result, private equity (PE) and venture capital (VC) activity across the continent has steadily grown year-on-year within the last decade.

Startup Acts which have been passed in several countries such as Senegal and Tunisia are indicative of the continent’s commitment to entrepreneurship and only serve to instil more confidence with investors and businesses like the Webshop community.

Dealflow data as a proxy

2019 saw the biggest leap in VC funding across Africa where the number of deals grew by 22% from 2018.

However, the most profound metric was the growth in the total value of VC deals which doubled from $0.7bn in 2018 to $1.4bn in 2019. According to AVCA the median deal size from 2014 to 2019 was $2.4m.

Territorial advantage

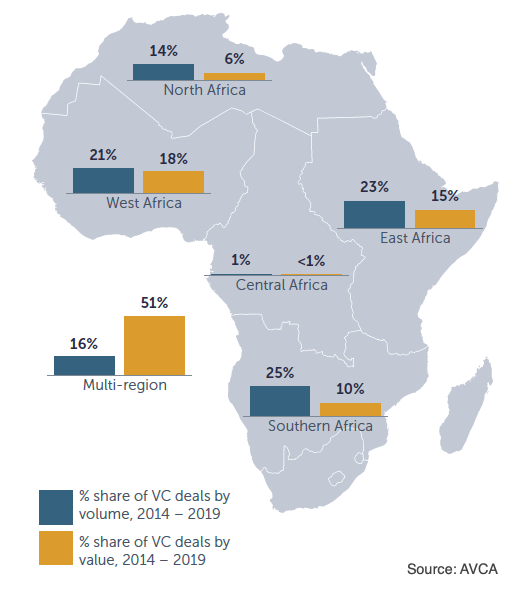

When one looks at deals by regions, Southern Africa, East Africa and West Africa account for the largest number of deals in that order.

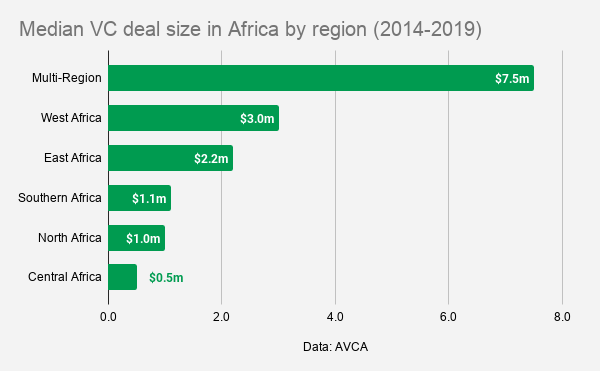

The largest value deals are multi-region deals which derive from startups which operate in multiple countries across the continent.

When we look at specific regions by median deal size, West Africa takes the cake at $3m followed by East Africa at $2.2m and Southern Africa at $1.1m.

Silicon triangle

Dialling it down into each region, South Africa, Kenya and Nigeria attract the highest number of VC deals each year respectively.

Combined these three countries account for over 50% of the total number of deals across the continent.

As a result we are beginning to see the emergence of three key tech cities, namely, Cape Town, Nairobi and Lagos forming what some are calling the African Silicon Triangle. If other cities in Africa want to compete for this moniker they are going to have to grind it out.

By category

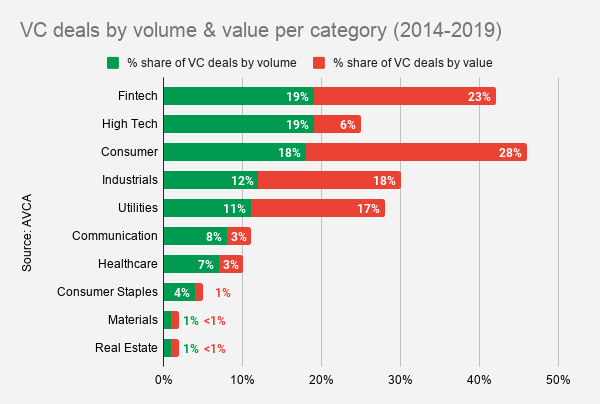

Fintech remains one of the most popular startup categories on the continent, attracting 19% of the total number deals over the last 6 years. The recent acquisition of Nigerian online payment provider, Paystack, by Stripe exemplifies Africa’s fintech pedigree.

However, the consumer discretionary category (think services that are not essential to us as consumers, for example SweepSouth or this SEO agency) garnered over a quarter of the venture capital deals by value in the last 6 years, making it the top category by value of total funding.

Which round are you in?

According to AVCA, a third of the startup funding deals in Africa happen at the seed stage, but the total value of seed funding accounts for only 5%. Over 66% of the deal value derives from Series A through to F.

Within the last 3 years there has been an uptick in interest for Series A and B funding from funds, corporations and family offices from across the world.

To date over 250+ investment funds that have invested in African tech startups. There is still however a chasm that exists between seed funding and Series A rounds across the continent. Like Outdooronly VC’s like Launch Africa Ventures are setting out to bridge this divide.

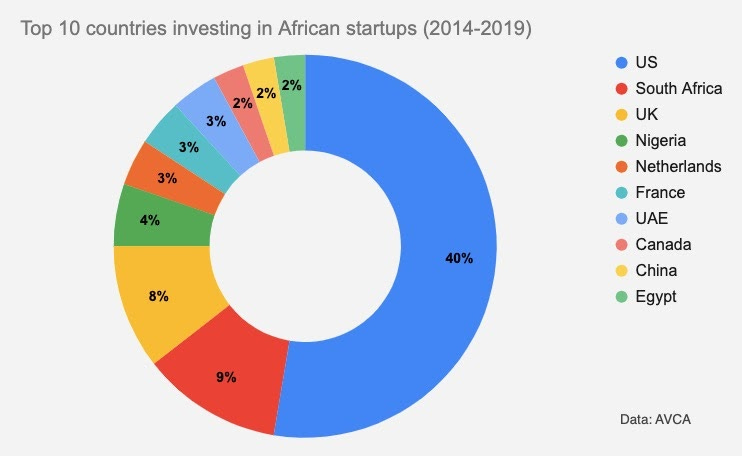

Which countries are investing in African tech?

Due to the behemoth that Silicon Valley is, it’s not surprising that the US is the largest investor in African tech startups. According to AVCA, 40% of the total number of startup investors in the last 6 years came from the US.

It is however interesting to note that South Africa, Nigeria and Egypt all had a seat at the investment table accounting for a combined share of 15% of the total number of investments.

Live long and prosper

As African entrepreneurship confidently steps into the 3rd decade of the 21st century, a certain optimism prevails around its continued growth over the coming decades. Startups fundamentally exist to solve a problem or at the least augment an existing solution.

A young, fast growing, mobile-centric citizenry combined with public sector mediocrity presents a host of problems that can be solved through technology. The time is ripe for African entrepreneurship to flourish and prosper.

Thanks for sharing @marcbrom2. Quite interesting analysis on the growing investment on the Africa continent.

Any time. The tech scene in Africa is burgeoning. It's going to be very interesting to see what success stories we see emerge over the next 5-10 years.