Growing a Revenue Analytics Platform to

$83,000/mo

Hello! What's your background, and what are you working on?

Hi there! I'm Josh Pigford, founder of Baremetrics. I'm maker at heart and have been building things for the web since the 90's.

Baremetrics is a business analytics & insights company. Right now we're focused primarily on providing tools for subscription companies to grow their businesses.

I've been self-employed for basically all of my adult life (minus a 7-week lapse in judgement right out of college). Earlier in my career I did design and development consulting for companies like Adobe, AOL, Dell, Groupon, Warner Bros and even did a presidential candidate's website in the 2008 election (let's just say the phrase "that blue isn't presidential enough" got used gratuitously).

In the years leading up to Baremetrics, I was building small businesses and products left and right with some minor successes and acquisitions along the way.

Currently Baremetrics is doing over $80,000/mo in revenue. We've made our metrics available publicly since 2014, which you can see here: demo.baremetrics.com.

What motivated you to get started with Baremetrics?

Back in 2013 I was running a SaaS company in the survey space. We had two separate products and with both of them I was having the hardest time pulling together some really basic metrics. Things like monthly recurring revenue (MRR), lifetime value of a customer (LTV) and churn rates.

At that point your only real option was to manually calculate that stuff in a spreadsheet or to hack together some stuff on the back-end. Manual calculation is a chore that will get put off over and over again (much like bookkeeping), and it's ripe for you screwing it up since it's manual-entry. Hacking it together could give some high-level insights but really isn't all that useful for actually running your business.

So, I decided to build something. Initially it was just going to be this internal tool for me, but I quickly realized a lot of other founders needed it as well.

I'm generally quite opposed to building internal tools, but there just wasn't anything out there to do this.

If I'm being totally honest, growth for the SaaS company I had been building had stagnated and on some level I imagine I was procrastinating a little bit. Or maybe I was just sort of psychologically putting out feelers to see if something else might work better? The grass is always greener, right?

In this case, the grass ended up being much greener.

What went into building the initial product?

One evening in October 2013 I was poking around trying desperately to find something to make getting all of these SaaS metrics easier and I just couldn't. So, I decided then and there to just do it myself.

I promptly tweeted about it:

Then I went downstairs and said to my wife in my burliest bearded man voice, "Honey, tonight I'm gonna build a business."

I didn't actually launch it that night. (Surprise! It was more complicated than I thought!) I did, however, launch it a month later.

I was bootstrapping everything and doing consulting work at the same time. So during this month I'm building Baremetrics, running the two products in the survey space, and working with two different consulting clients. I was… busy.

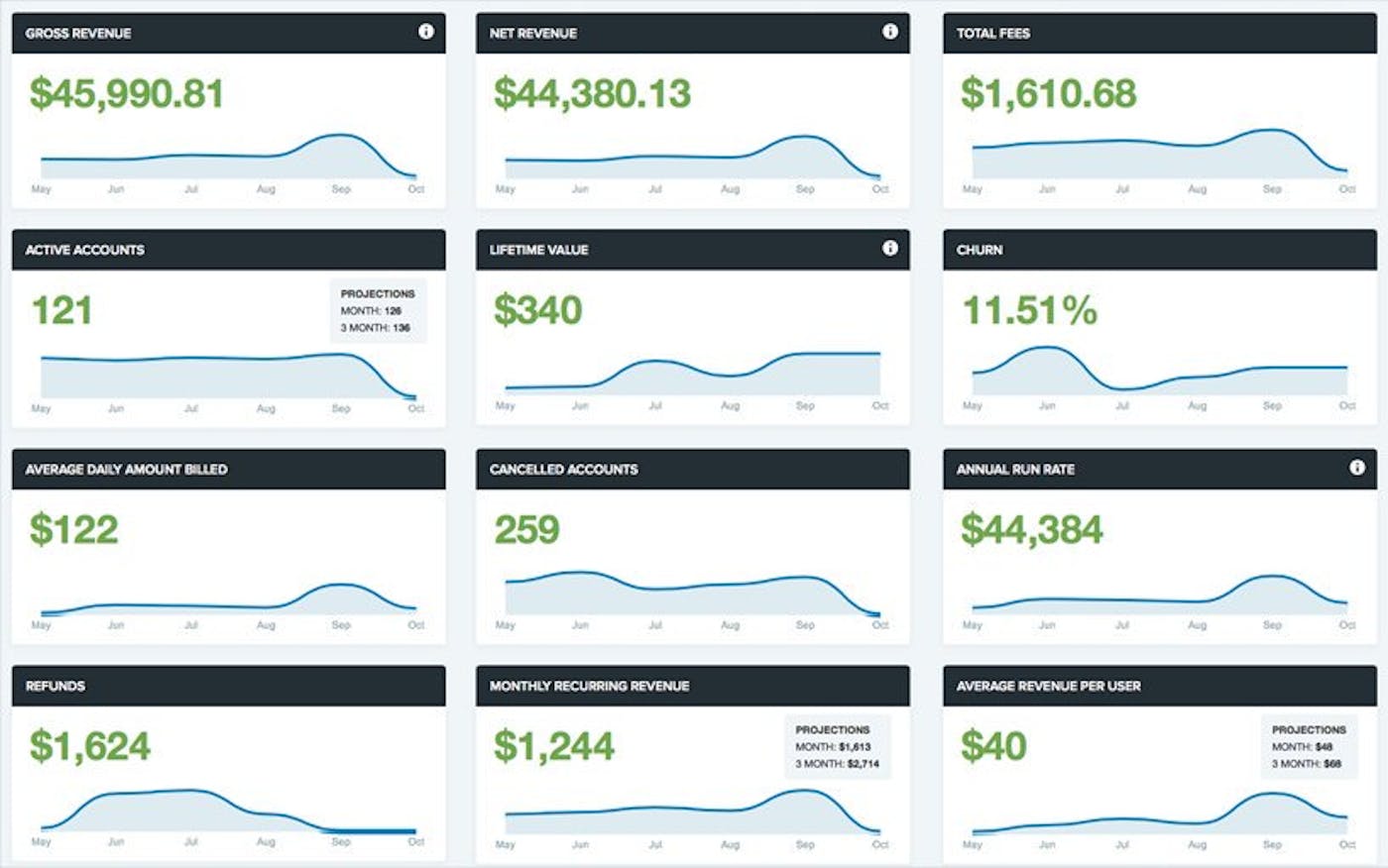

In reality I spent about 7-8 working days in total to get the very first version of Baremetrics shipped. That first version definitely embodied the "bare" in Baremetrics:

It was essentially a static dashboard that only showed the current day's relevant number and then a line graph that only went back six months. Curious what your MRR was last month? Too bad! Wondering how much you've reduced churn in the past year? Sorry! On top of that, the data only updated once a day… if the stars aligned properly. It was janky.

I was building this first version for me. I did basically zero customer research. I wasn't going after a specific market. I was scratching my own itch. This version solved my problem, and given I was juggling so many other things, it seemed unwise to spend a huge amount of time researching this.

I just needed to ship it and see what happened.

Baremetrics has obviously grown a ton since then. How'd that happen?

Typical wisdom tells you that you need to build hype and generate buzz. Start a blog! Collect email addresses! Build a landing page and people magically drop in their email address! Have a private beta! Give out free accounts! Give out coupons! Invite influencers to try your product! Send out press releases!

I did none of those things to get our first customers.

My secret weapon—the source of the majority of Baremetrics' first customers—was Twitter.

But just saying "Twitter" is slightly misleading. It's not like I did some sort of #growthhacking and generated a million signups in an hour or anything. The fact is, Twitter was simply the medium for the actual mode, which was word-of-mouth.

When I first launched Baremetrics, there was a small group of other founders I knew. I reached out to them, they became users, and they started the word-of-mouth snowball. Simple as that.

Our first 100 paying users very much came from that.

The reason word-of-mouth worked well was one thing: pain. Pain, on some level, plays a part in nearly every business decision you make. Look at every B2B product that's ever been built. It's almost always been birthed out of the need to get rid of a painful process. The reason is, pain is inefficient. We avoid it at all costs.

That's what Baremetrics did for businesses right out of the gate, it's the reason anyone has signed up at all, and it's why they keep signing up. We're solving an actual pain point for a lot of businesses, and when you take pain away, people talk about it.

Past word of mouth, we did have one particular marketing play that paid off pretty significantly and continues to be a big driver of new customers here 3 years later.

| Month | Customers |

| Dec | 28 |

| Jan | 50 |

| Feb | 78 |

| Mar | 95 |

| Apr | 156 |

| May | 205 |

That graph is our Active Customers for the first 6 months. You notice in April there's an uptick. That month, we partnered with Buffer to make their entire set of revenue metrics public: buffer.baremetrics.com.

At the time they were "only" doing $250,000/mo (they're doing over $1M/mo now), but even then they were very well known for being transparent. We helped them capitalize on that and made their numbers even more accessible, which aligned very well with their values while also helping us get more exposure.

That entire thing came about after a conversation at a dinner with Hiten Shah (who is, among many other things, an advisor for Buffer) while at MicroConf. A couple of months prior, I had made our dashboard public (demo.baremetrics.com), which Hiten was aware of. After a simple, "Hey, I think the guys at Buffer would love to make their dashboard public, too. I'll do an email intro," the ball was rolling.

After both of our companies made our metrics public, we started getting more companies asking to do the same, which ultimately led to the launch of the Open Startups initiative.

What's your business model, and how have you grown your revenue?

We've got a pretty vanilla SaaS subscription setup where we charge anywhere from $50 up to $1,000+ per month. We've experimented with prices as low as $25 but ultimately found most customers on that plan weren't really in a great position to get a lot of value (i.e. really new businesses with too little data to get meaningful insights).

Right out of the gate, day one, we charged for Baremetrics. In fact our very first sign up was for our $250/mo plan. In the early days we had no free trial… you had to pay immediately. We had a generous money-back guarantee policy that we kept in place for our first year, and we did a lot of refunds based on folks not actually being compatible.

Prior to Baremetrics, I was always scared to charge too much for the SaaS products I'd built. Maybe I subconsciously knew they weren't providing a ton of value? I don't know, but I knew with Baremetrics that I wanted to push the average price point up to $100+ per month instead of $20.

In the early days it was a slightly harder sell, because I was sticking to my guns on the higher price points, even though the product was still very raw and basic. Regardless, I was able to charge plenty of businesses $100+ per month because, at the core, we were solving a significant pain point.

This idea that you need to water down your pricing or offer a free beta period is bogus, as doing that implies you've got a core, foundational issue with the problem you're solving. Your product should get more valuable over time, yes, but there's a base level of value you should be providing no matter what. And that's where your pricing should start.

Don't get distracted by people telling you your product is too expensive. There's a much higher probability that they just aren't your customer vs. there actually being a pricing problem.

One thing that's been maddeningly frustrating is how features rarely move the needle. That's not to say they are useless and you'd be just as well off not adding them, but rather most feature additions just reinforce the value you provide instead of creating actual, tangible, chargeable, new value.

If you look at that chart (it's our all-time MRR chart) you see all the little speech bubbles across the bottom. Each of those is an annotation associated with a feature launch. Notice anything in particular? How about how basically zero of those items did anything measurable to the chart? That's the "maddeningly frustrating" bit I'm referring to.

It's incredibly easy to get caught up in the idea that if you "just get this next feature out the door" you'll somehow stumble upon a bottomless pile of gold, but unfortunately that next feature will likely do nothing meaningful to your revenue.

Now, as soon as I say that, you may point out that last point on the graph! The angle/growth for that month was… more betterer. 🙂 Why was that? Two big things.

One, we launched a major new feature called Recover. It automates collecting on failed charges and has lots of great features, like in-app payment forms and notifications, among other things.

Two, we priced that new feature as an add-on. That proved to be a really great move from a revenue growth standpoint. The reason add-on pricing worked really well here is that it's a feature that not everyone will make use of, so just bundling it inside our normal pricing plans meant it'd get buried and we also would be undercharging for it in most cases.

Not only was it priced as an add-on, but the actual amount of that add-on scales based on your MRR, as there's a pretty direct correlation with how much money you stand to actually recover with the feature.

This allowed us to make quite a bit of additional recurring "expansion" revenue, which is new revenue from your existing customers.

As of today we're doing over $80,000 a month in recurring revenue. You can see all of our current numbers at demo.baremetrics.com.

What are your goals for the future?

At the end of the day we want to help businesses not only know their data but know what to do with the data. So what if you know that your user churn is 5%? Why is it 5%? And how do you improve it? And what about data you don't even know to look for?

You shouldn't need a data science or business degree to get business insights. It should be accessible to anyone at any skill level.

That's the stuff we're working towards.

If you had to start over, what would you do differently?

I've made an infinite number of smaller, relatively inconsequential mistakes, but there are two substantial decisions that had bigger implications on the company as a whole.

The first was thinking too small. The beginnings of Baremetrics are rooted in me scratching my own itch. Initially I had no intention of it even being more than a little internal thing that got me a few high-level numbers.

The whole thing just sort of organically grew and expanded into more metrics and tools as I started getting a better idea of what problems other businesses were having.

I made a lot of infrastructure and code decisions early on based solely on the "SaaS analytics for Stripe" niche, and we spent the better part of a year digging ourselves out of that hole to be able to performantly support businesses across lots of different data sources.

The second was not obsessing over our finances after we raised a round of funding. Back in 2014/2015 we raised $800,000. To me, that felt like $8 million, and like we couldn't possibly spend all of that… and I was so very very wrong. Last June I realized we only had a few weeks of cash left in the bank and had to make some tough decisions.

After 8 months of pay cuts and changes in the team, we managed to grow the business, get everyone back to full pay, and become profitable!

I learned a really tough lesson about how important it is to manage your burn rate and not be overly optimistic about growth. It's easy for any business to end up in this situation if you've got any amount of money sitting in the bank (whether that's from external funding or just a large amount of cash reserves). The temptation is to spend ahead of your growth and doing that is risky.

You just have to be really careful and a bit pessimistic about your finances to keep from making decisions you can't pull back from.

What were your biggest advantages? Was anything particularly helpful?

The biggest advantage early on was that nobody else was doing this. Stripe was really starting to gain steam, but at the time nobody had built anything really significant on their API. (Yes, tons of people were integrating their API to accept payments, obviously, but there was very little in terms of business tools built on top of it.)

This meant that, at the time, Baremetrics was a bit of an anomaly. Lots of folks were looking for analytics/metrics from their Stripe accounts, but there just wasn't any way to do it without building something yourself.

This was great for me — there was no direct competition and I was able to form some really great relationships early on with the folks at Stripe (relationships that extend both formally and informally to this day).

That's not to say I planned any of that… it was just right place, right time.

Other than luck, I do think the prior 10 years of building and shipping things put me in the right mindset to not get hung up on having a "perfect" product. I built the first version in basically a week, and then two months after launching I rebuilt the whole thing from scratch again.

I see a lot of newer entrepreneurs get caught up in building everything they can think of and then 6-12 months in they still don't have a paying customer. They just get burnt out and never actually ship anything meaningful.

It's important to get customer feedback from real, paying customers as soon as humanly possible.

What's your advice for indie hackers who are just starting out?

What I hinted at before about shipping things quickly is crucial. The most dangerous things in the early days are assumptions, which lead you down a path that you have no clue where it's headed. Assumptions are the riskiest part of being an entrepreneur, because you're working without a feedback loop. Or, more specifically, your feedback loop is your own brain telling you it's the greatest thing you've ever created, which is almost certainly patently false.

The faster you can ship things, the sooner you can stop with the assumptions and make decisions based on real usage and feedback.

In that same vein, don't get overly attached to your ideas. Your amazing ideas are actually terrible ideas if you can't get anyone to use them or pay for them. As fast as you ship things, you should also kill things (in the product sense).

The eternal piling on of features without measuring if those things are continuing to provide value results in bloated software that doesn't actually do anything particularly well.

Where can we go to learn more?

I love talking shop! Seriously, please reach out. Would love to hear what you're working on, and I'd love to help however I can.

- Email: [email protected]

- Twitter: @Shpigford

I also attempt to write weekly about growing your business here: baremetrics.com/blog

Good Read

Great article! How difficult is the onboarding process for customers? Is it just a matter of getting access to their stripe API? (Sorry, I've never used stripe before). Are you worried that Stripe might eventually come out with their own analytics platform in the future?

It's Stripe, Recurly, Braintree and you can also use our own API to just pass us the subscription data directly. But yes, the setup process for an existing processor is just a simple "connect" process where they authorize API access for us.

As for Stripe, yes and no. They've already rolled out some analytics (and then removed them) so they're apparently still on shaky ground with that.

At the same time, we've spent over 4 years learning the intricacies and edge cases for generating meaningful analytics and business insights, so we've got experience on our side. It's a lot more complex than you'd ever imagine (I probably wouldn't have built Baremetrics if I knew how hard it'd be).

But in addition to that, we do a lot more than just "analytics" and continue to expand our suite of tools outside of just a dashboard of numbers. So...long answer: naaa, not worried. :)

Thanks!

One of the company that I always check out their progress. Awesome great story!

Great SaaS success story. Thanks for sharing.

Thanks for the interview, what kind of clout did you have on twitter when you launched? Did you already have quite an engaged following? How much networking do you do in the real world?

Thanks! I did have some huge following (maybe 1000 people?) but it was definitely a lot of other founders, which helped. I do very little networking in the real world...I live in Birmingham, AL and there's hardly a "tech scene" here.

That's very inspiring that you were able to launch from Birmingham, AL. Based in the ATL myself. I'll definitely shoot you a tweet or an email when (not if) I come up with my idea...or better yet, when I ship it!

This comment was deleted 7 years ago