Things every indie hacker should know about monetary

economics

A simple "explain it like I'm 5" guide to help you become conversational about credit, interest, inflation, and the Fed.

Do your eyes glaze over when someone mentions interest rates or the Fed?

If so, you're not alone. Tons of indie hackers are too busy building and shipping to dive into economics. But understanding the economy doesn't have to be hard.

Below we've written a very simple explainer of the basics that anyone can understand: no jargon, no judgment, just the essentials that will help you make smarter business decisions.

Let's start with why credit is important.

The economy may seem complicated, but at its heart, it's just a massive collection of transactions. Every time someone buys your SaaS product, and every time you pay a freelancer, money flows from one person to another. These transactions happen through two main channels:

Cash: Spending money you already have.

Credit: Spending money you don't have, that you're borrowing from someone else, while promising to them pay back later.

Credit is important, because when businesses can easily borrow money, they don't have to wait until they have all the cash needed for growth, so they can grow faster. They can immediately hire people, buy equipment, and expand now. The same is true for consumers. When consumers can easily borrow money, they can immediately buy houses, buy vehicles, and start businesses.

All of this spending creates transactions, which, as we said earlier, are what make up the economy. The recipients of this spending—the employees, homeowners, businesses, etc. being paid—can now spend their their newly earned money on things they want and need. In other words, there are even more transactions and payments.

This ripple effect is why easily available credit acts as a multiplier on the economy. Credit makes the economy move.

As an example, consider buying a house:

Most people can't afford to save up the full price of the home they want, so they take out a mortgage, which is just credit for buying a house.

Without this credit, they'd have to rent for decades while saving up.

As a result, construction companies would have fewer houses to build, so they would employ fewer workers and buy fewer construction materials.

Construction material companies would therefore have fewer customers to sell to, so they'd make less money, so they'd spend less money hiring employees, paying accountants, and buying tools of their own.

And so on and so forth.

Just this one type of credit unlocks an entire chain of economic activity that would suffer without it.

Since credit is so important, interest rates are important, too.

Just like goods and services have a cost, credit also has a cost. When people and businesses borrow money, they have to pay interest. Think of interest as the price tag for credit.

Interest rates are simple to understand. For example, if you borrow $100,000 at a 5% annual interest rate, then after one year, you owe the $100K you borrowed plus an extra $5,000 (5% of the $100K) to cover the interest.

The lower interest rates are across the economy, the cheaper it is for everyone to borrow money. And the cheaper it is for everyone to borrow money, the more money they borrow. As we saw earlier, more borrowing leads to more spending and thus more economic activity for people, employees, and businesses.

So low interest rates and lots of credit are often seen as a good thing that gets the economy moving, whereas high interest rates mean less borrowing and a slower-moving economy.

But where do interest rates come from, and what causes them to rise and fall?

Interest rates are controlled by the Fed, so the Fed is important.

People and businesses typically borrow money from banks, so the banks charge interest rates, which allows them to profit from the money they lend.

But banks themselves also borrow money—often from each other or from a "central bank." Unlike regular banks that serve people and businesses, a central bank serves the entire banking system. In the U.S., the central bank is the Federal Reserve, or the Fed for short.

Just like the rest of us, banks that borrow money also have to pay interest, and that interest rate is set by the Fed.

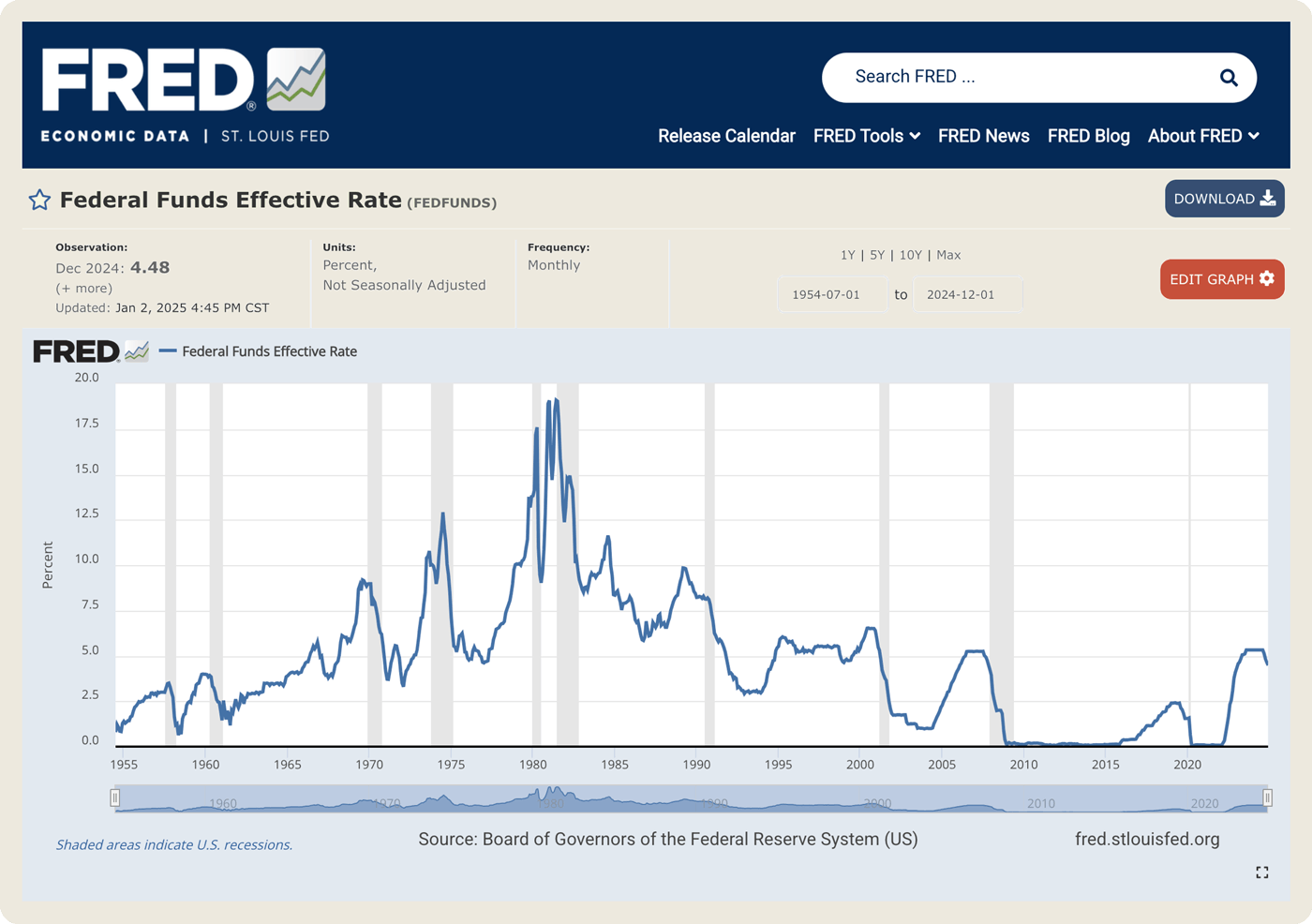

About eight times per year, policymakers from the Fed get together, analyze economic data, and decide whether to raise, lower, or maintain the interest rate, also known as the Federal Funds Rate.

You tend to hear a lot buzz about the Fed raising or lowering rates in the news. There's even a lot of speculation about what the Fed might do. It's extremely important to people, because the rate set by the Fed causes a ripple effect.

For example, when the Fed raises interest rates, it's more expensive for banks to borrow money. So banks raise their interest rates for everyone who borrows from them, and it becomes more expensive for everyone to borrow money. This affects spending decisions throughout the entire economy. It's common for rate hikes to hurt stock prices because if borrowing is more expensive, that eats into the profits of most companies.

But why would the Fed ever choose to raise interest rates?

The Fed makes decisions based on inflation, so understanding inflation is important.

The economy is a little bit like a thermostat. As we've seen, if there's too little economic activity, it can get "too cold." When people and businesses aren't borrowing as much, they aren't spending as much. That means businesses aren't earning or hiring as much, so fewer people are employed.

But it's also possible for the economy to get too hot. Imagine an economy with tons of activity:

Lots of economic activity means a lot of spending. For example, people buy more clothing, companies hire more employees, etc.

The more companies hire, the more competitive it is to hire good employees—imagine lots of fishermen all fishing in the same spot.

So companies offer higher salaries to compete and attract employees. As a result, people get paid more.

The more people get paid, the more they tend to spend. So sellers start to see a lot of demand for their cars, clothing, food, etc.

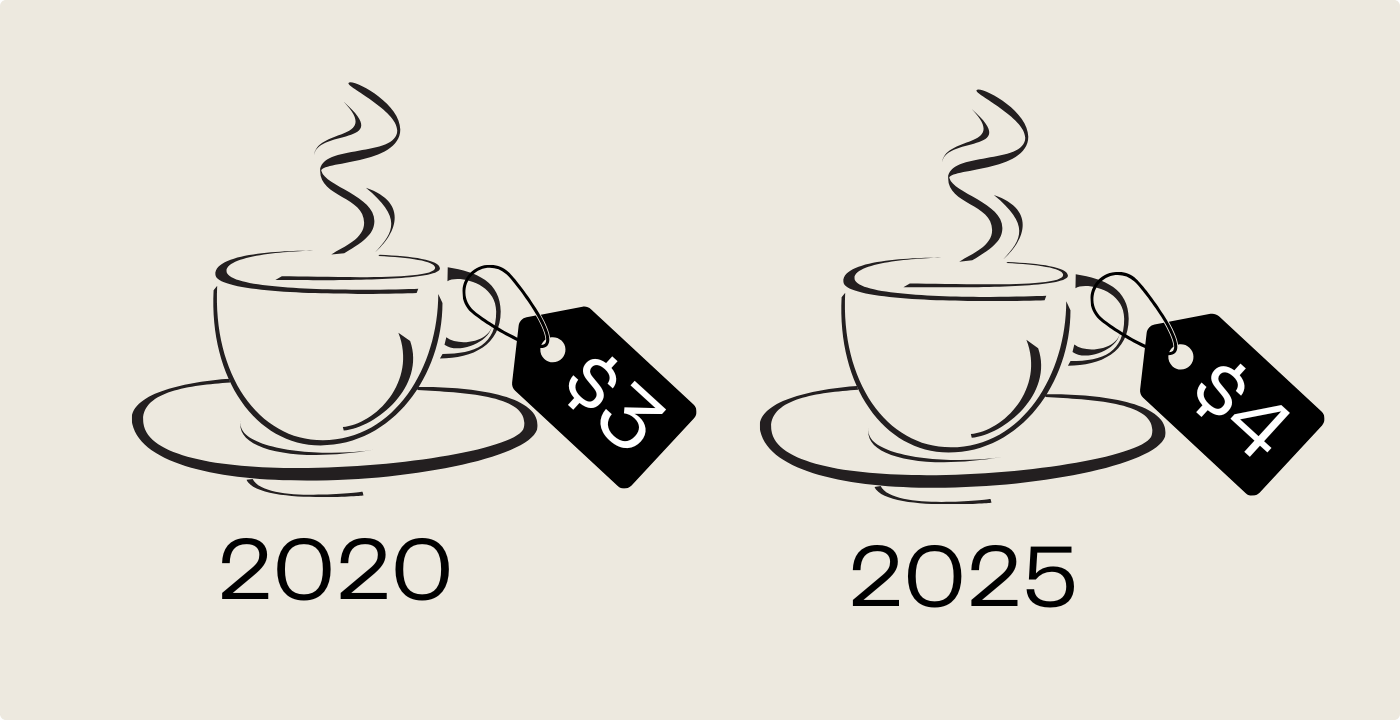

When sellers struggle to keep up with demand, they hire more people to produce more goods, and the loop repeats. But they also tend to raise prices. This is known as inflation—the general increase in the cost of goods and services.

So a hotter economy means more spending, and more spending means things get more expensive.

Inflation is normal and generally expected. It's a sign of a growing economy. But if inflation happens too fast, it can grow faster than wages grow, and outstrip people's ability to pay for things. That's how things can get too hot.

The Fed, being a government agency, is mandated to do what's good for the country. It doesn't want the economy to get too hot and cause runaway inflation, nor does it want the economy to get too cold and cause high unemployment. So when the policymakers at the Fed get together and decide whether or not to raise rates, they consider factors like recent unemployment and inflation rates:

When the economy seems too hot, the Fed will often raise rates to slow down borrowing, and thus slow down spending, and cool off the economy.

When the economy seems too cold, the Fed will often lower rates to encourage borrowing, encourage spending, and lead to more hiring.

Inflation is the steady rise in prices over time. That $5 latte you bought last year might cost $6 this year. For indie hackers, inflation affects both sides of your business:

Your costs go up (hosting, salaries, marketing).

Your customers' budgets get squeezed.

You can actually use this information in your own business.

Generally, interest rates below 3% are considered low, while rates above 5% are considered high. Websites like the Federal Reserve’s FRED database, Bloomberg, or even just a quick Google search can help you track trends in inflation and interest rates.

When interest rates are low, it's a prime opportunity to grow your business.

Low rates make borrowing cheaper, which is why companies like Stripe and others went on massive hiring sprees in 2020-2021.

Access to affordable capital allows businesses to scale faster without significantly increasing costs.

If you're considering expanding, refinancing debt, or taking out a loan, low-interest periods can be a great time to make those moves.

On the flip side, when interest rates are high (like they are now), it's a good time to focus on efficiency and stability.

High rates make borrowing more expensive for everyone, which is why you see more layoffs and budget reductions in high interest rate periods.

Even if you're not directly effected because you aren't planning to borrow money, your customers (and their customers… and their customers) will very possibly have less money to spend.

We hope this was helpful!

Economics doesn’t have to be intimidating, and it’s more relevant to your startup than you might think.

If you're interested in more articles like this, let us know.

Really like the “explain it like I’m 5” approach. Feels especially important for indie founders who need to make decisions without overcomplicating things.

⭐️⭐️⭐️⭐️⭐️ Grateful for Professional Crypto Recovery Support

After falling victim to an online scam last year, I lost 1.3 Bitcoin, which was devastating and incredibly stressful. For weeks, I felt stuck and unsure if recovery was even possible. Instead of giving up, I continued researching legitimate recovery options and eventually came across a specialist who took my case seriously.

The process required patience, documentation, and clear communication, but I was impressed by the professionalism and transparency throughout. To my relief, I was eventually able to recover my stolen funds, something I honestly thought might never happen.

I’m truly thankful for the guidance and effort provided during such a difficult time. If you’ve experienced a crypto-related scam and are looking for professional assistance, it’s worth reaching out and exploring your options. (RECOVERYCOINGROUP AT GMAIL DOT COM)

This is a great topic. A lot of founders focus on product and growth but ignore how money, credit, and interest rates actually affect customer behavior and startup costs. An ELI5 breakdown like this is super useful, especially for non-finance founders. Looking forward to reading it.

the most comprehensible monetary economics for non-financers, thanks!

I like how you connected interest rates and inflation directly to founder decisions like growth, pricing, and runway. It’s a good reminder that macroeconomics quietly shapes even the smallest indie projects.

helpful,thanks

very helpful, thank you for sharing

Inflation is NOT normal and generally expected!

Reading "Broken Money" and "Price of Tomorrow" really changed my perspectives on this.

Inflation is caused by the expansion of the money supply (rather than just a rise in prices which is a symptom of inflation), is not a natural or inevitable feature of a healthy economy. Instead, it is often a consequence of deliberate monetary policy decisions, such as central bank interventions like quantitative easing or artificially low interest rates. These policies distort market signals, leading to malinvestment, rising costs for consumers, and an erosion of purchasing power - issues that disproportionately impact small entrepreneurs and indie hackers.

For indie hackers, inflation isn’t just an abstract economic concept; it directly affects their ability to bootstrap and sustain their businesses. Rising operational costs and declining real purchasing power make it harder to save, invest in growth, or remain competitive. Meanwhile, the Cantillon Effect ensures that those closest to new money (e.g., large corporations or well-funded startups) benefit first, leaving smaller players to struggle with the downstream consequences of inflationary policies.

Historically, periods of deflation or price stability - common in economies with sound money systems - have coincided with significant technological advancement and prosperity. In such environments, indie hackers could thrive as the value of their savings holds steady or even increases, giving them a stronger foundation for sustainable growth.

Instead of accepting inflation as "normal," we should be questioning the whole system and policies that perpetuate it!

Thanks for the comment, will have to add some of these books to the reading list.

That said, the pragmatist in me says that it's unlikely there'll be a popular revolt that changes our monetary system any time soon. Even if there is, there's no guarantee that whatever we change to won't have its flaws.

So for people who aren't as passionate about how things "should" or "could" be in this arena, it's worthwhile to gain a simple and practical understanding of how things "are."

I'd say Bitcoin is the popular revolt you speak of.

I think all Cryptos are just short of trap for future specially for western people. Rich Americans are accumulating gold to survive the upcoming economic crises and meanwhile wants common masses to buy crypto which is not backed by anything sustainable.

This is actually very helpfull, especialy for me as a teen. Thank you very much!

I appreciated the in depth elaboration particularly on debt! Thank you

The thermostat analogy works well because inflation isn’t just about prices going up — it’s about feedback loops. Higher wages increase demand, demand pushes prices, and price pressure feeds back into hiring and borrowing decisions. Rate changes make sense as a way to slow or speed up that loop rather than “fix” prices directly.

Extremely helpful! Thank you

this was explained better than my entire high school did

This is a clear and friendly way to explain a hard topic

The examples make money ideas feel less scary and more real

It is useful for builders who just want the basics without stress

I would share this website with others who want a simple overview

When interest rates are high, VC's are typically on capital preservation mode. So more room for bootstrapped founders.

Awesome breakdown. I love how this makes credit, interest, inflation and the Fed feel relevant to indie hackers. Too often we focus only on code, features and customers, but forget how macro-economics shapes our runway, pricing and growth potential. Making monetary economics simple and intuitive helps build stronger, long-term decisions especially in uncertain times. Thanks for writing this

Wonderful ELI5 (Explain Like I'm 5) guide! It's essential for indie hackers to have an understanding of the fundamentals of credit, interest, and inflation to align their business planning with monetary ideas. This can help you become more informed about runway and pricing decisions.

Thanks for simplifying the topic! It was very helpful in fully grasping it! I liked the breakdown of the repercussions behind every decision as well as suggestions on what to do with your business.

I would love to read more articles like this one.

Looking for a compelling press release to promote your Christmas event or holiday campaign?

Prime Nova Solutions Professional Press Release Writing & Distribution

Looking to give your announcement the visibility it deserves? Prime Nova Solutions provides expertly crafted press releases and strategic distribution designed to amplify your message and strengthen your brand presence.

We specialize in high quality PR writing across a wide range of industries, including:

Crypto & Blockchain PR Clear, authoritative releases for projects, exchanges, tokens, and innovations.

Music PR Artist features, release announcements, event promotions, and industry visibility.

Product Launch PR Compelling content that highlights key features and market impact.

Book PR Engaging press releases for authors, book launches, and promotional campaigns.

Christmas & Seasonal PR Festive, engaging messaging tailored for holiday marketing and events.

What you get:

✔ News-ready, professionally written press releases

✔ Strong storytelling that attracts media and audience attention

✔ Targeted distribution to reputable outlets

✔ Fast delivery and clear communication

Connect with Prime Nova Solutions:

WhatsApp: 08060371685

Let’s amplify your story and get your announcement in front of the right audience.

Had fun reading this. We indie devs often bury ourselves in programming, ignoring how the wider economy can nudge even small projects. You broke down interest rates, borrowing power, and cash flow without sounding like a textbook - more like a chat over coffee about real impacts on your routine work

That bit about caring more about getting things done right - rather than racing toward big numbers - took hold. Given how shaky money stuff feels these days, keeping people around while sharpening what you offer beats wild revenue jumps hands down. Shows it's smarter to take your time crafting something tough enough to last, not just shiny for screenshots.

Appreciate you putting this together - hit home a few times, honestly. Can't wait to see what else comes your way.

Great post! Breaking down monetary economics in simple terms is so valuable, especially for founders and indie hackers who aren’t trained in finance. I’ve noticed a similar challenge outside the startup world too.

In my work on NGO Finance Management at NGO Finance Hub, I see charities and nonprofits facing the same issue: complex financial rules (like UK SORP accounting, Gift Aid, or restricted funds) that sound intimidating until they’re explained clearly. When simplified, it empowers trustees, donors, and managers to make smarter decisions — just like startups benefit from understanding credit, inflation, or interest.

Whether it’s startups or NGOs, the principle is the same: clear finance knowledge = stronger sustainability and better decision-making.

Very well broken down article! Well done!!!

This was very well broken down. Great job!

Would love to see more tips on handling inflation or currency risks, especially for global businesses. Thanks for sharing this valuable resource!

IF YOU WANT TO RECOVER YOUR STOLEN BTC CONTACT GEO COORDINATES RECOVERY HACKER FOR ALL KINDS OF HACKING JOBS

The internet today is full of scammers. But here is some good news to everyone who has been a victim of internet scammers. You can get your money back from the scammers. If you have been a victim to internet scammers, then you should contact GEO COORDINATES RECOVERY HACKER. I have been a victim of online scams. I lost $723,000 worth of BTC. I saw where so many people recommended GEO COORDINATES RECOVERY HACKER. Hackers who have dedicated time to helping individuals to get back their money from internet scammers. Recovering lost Bitcoin can require unique hacking skills and expertise that are possessed by only a handful of professional hackers, it’s best to seek out a trusted hacker like GEO COORDINATES RECOVERY HACKER who can help you recover your funds. Am here to give glory to GEO COORDINATES RECOVERY HACKER. You guys did a great job for me. And all of this was done at an affordable price. Thanks a lot. To get in touch with the recovery hacker, you can contact them via

Telegram; @Geocoordinateshacker

IF YOU WANT TO RECOVER YOUR STOLEN BTC CONTACT GEO COORDINATES RECOVERY HACKER FOR ALL KINDS OF HACKING JOBS

The internet today is full of scammers. But here is some good news to everyone who has been a victim of internet scammers. You can get your money back from the scammers. If you have been a victim to internet scammers, then you should contact GEO COORDINATES RECOVERY HACKER. I have been a victim of online scams. I lost $723,000 worth of BTC. I saw where so many people recommended GEO COORDINATES RECOVERY HACKER. Hackers who have dedicated time to helping individuals to get back their money from internet scammers. Recovering lost Bitcoin can require unique hacking skills and expertise that are possessed by only a handful of professional hackers, it’s best to seek out a trusted hacker like GEO COORDINATES RECOVERY HACKER who can help you recover your funds. Am here to give glory to GEO COORDINATES RECOVERY HACKER. You guys did a great job for me. And all of this was done at an affordable price. Thanks a lot

Telegram; @Geocoordinateshacker

HIRE A CERTIFIED BITCOIN RECOVERY EXPERT// THE HACK ANGEL

There are good-quality recovery agents out there who are legit and honest when it comes to recovery. I was a victim of Bitcoin investment fraud which I regretted not happening to anyone. What matters is the strangeness in you because being broken is not for weakness. I fell victim to a Bitcoin scam that saw me lose all my assets within a space of five days, I was catfished by a person who pretended to be a Bitcoin trader and investor, after depositing close to a million into this fake Bitcoin exchange, it was impossible to withdraw my assets and all communication with this so-called trader was compromised. I felt like I was going to die, until a friend of mine introduced THE HACK ANGELS RECOVERY EXPERT, a recovery agent that helped me recover all my stolen funds. I thought it was impossible, they recovered everything in less than 48 hours. I was in awe of how quick and easy it was, I can personally assure you all that THE HACK ANGELS RECOVERY EXPERT is a team of relentless, reliable, and trustworthy Bitcoin and data recovery experts. You can reach out to them with this information if you have any reason to

WhatsApp +1(520)200-2320

If you're in London, you can even visit them in person at their office located at 45-46 Red Lion Street, London WC1R 4PF, UK. They're super helpful and really know their stuff! Don't hesitate to reach out if you need help.

Well i didnt expect to learn something new today but there you go!! thankyou for breaking it down!

IS IT POSSIBLE TO RECOVER LOST CRYPTO? YES, ONLY HACKANGELS

Hey, my name is Frank, and I'm a crypto trader! I just wanted to share my incredible experience with The Hack Angels. They are truly exceptional when it comes to crypto recovery. They managed to recover my lost $1.7 million worth of Bitcoin from a scam, which I honestly thought was impossible. If you ever find yourself in a similar situation, I highly recommend reaching out to them.

You can contact them through their hotline at +1 (520) 200-2320 (available on phone/WhatsApp)

If you're in London, you can even visit them in person at their office located at 45-46 Red Lion Street, London WC1R 4PF, UK. They're super helpful and really know their stuff! Don't hesitate to reach out if you need help!

THANKS TO THE SERVICES OF THE HACK ANGELS // FOR HELPING ME RECOVER MY USDT AND BTC

I lost almost $698,000 in a bitcoin investment scam a few months ago. I was devastated and depressed, and I didn’t know what to do. When I saw a favorable review of THE HACK ANGELS RECOVERY EXPERT. I decided to contact them and voice my concerns. God is so good that I am a living testament to the fact that there are still legitimate recovery hackers out there. I will confidently recommend THE HACK ANGELS RECOVERY EXPERT to everyone I meet. I will suggest them to anyone who falls victim to any kind of online scam by using the information below.

WhatsApp; +1(520)-200,2320

If you’re in London, you can even visit them in person at their office located at 45-46 Red Lion Street, London WC1R 4PF, UK.

Exciting to see Stripe entering the stablecoin space! This could open up huge possibilities for faster, low-fee transactions across platforms. Innovations like this are great for fintech apps like Lucky 101, which are always looking for better ways to offer seamless and secure payment options to users.

Super clear ELI5. The “credit as a multiplier” section finally clicked for me. Also helpful to hear what high vs. low rates mean in practice for indie hackers (grow vs. tighten). Bookmarked.

Great insight !!

so intersting and important !

Explained precisely! My startup Mailmercy is expecting to get early adapters for now

This is fantastic. The "explain it like I'm 5" approach makes complex concepts like credit and inflation simple.

A suggestion for fellow founders: watch interest rate trends. Low rates? Consider growth investments. High rates? Focus on efficiency and customer retention.

Understanding these basics is a game-changer for making smart business decisions. Thanks for demystifying the economy!

Loved this angle — not enough founders think about the macro layer when building.

At HiDash, we’re building a lightweight insight dashboard for small SaaS and indie projects, and we’ve seen that some revenue swings are actually tied to macro events (e.g. inflation seasonality, Stripe payout delays).

Do you think small indie founders should factor this into pricing decisions? Or is that only relevant once you hit scale?

This was great and super informative thanks. Crazy how much needs to happen and controlled in terms of economics to maintain against inflation and other.

This is very well written in simple terms. The economy is complex, but you’ve broken down each aspect clearly and understandably. Thank you!

Great info here

Crafted well, perfect example of explaining complex problem

This is an awesome post. I really wish we could see some lower rates to take some pressure off home buyers but maybe we just need to see some price decreases in that sector. Always seems like supply is an issue too.

looks great

One thing that's never explained is why increased spending "causes" inflation. Is the theory (although not a theory because it actually happens) that if everyone is buying my product at $5 I will hike the price to $6 because I can?

It comes down to supply and demand. If the demand increases the supply decreases. This creates scarcity. Scarcity increases perceived value leading to increase in pricing

awesome

Very informative. One of my first jobs was as a telemarketer selling bank of America credit cards. You be surprised how much this helped me later in life. APRs annual fees balance transfers, minimum payments, you be surprised how many college grads in economics still don't know these terms or how they work.

That sounds right and insightful

Love how this breaks down dense macro concepts into startup-relevant insights. One thing I’d add: in high-rate environments, pricing strategy matters more than ever. Are indie hackers thinking enough about elasticity in their offerings?

Very helpful, feels like a minimalist introduction to monetary economics.

Really refreshing to see this kind of long-term, macro view in a space often dominated by "growth hacks" and quick wins.

As someone building an AI-based pricing tool (Pricewise), I’m increasingly aware that most indie founders underprice not because they want to — but because they don’t understand what their product means economically to their customers.

The “value of money” and “perceived worth” are often out of sync, especially in SaaS. I’ve seen virtual users (via GPT simulations) say no to $10/mo if the narrative is wrong, but say yes to $49/mo if framed properly.

This post makes me wonder: what would a more economically-literate pricing strategy look like for indie tools?

Thanks for this perspective 🙏

So what are some generally good conditions for a country (besides the US) to buy a house, meaning taking on a mortgage?

Thanks for sharing these information .

The best information on both Money and Economics i have come across, great work

Well explained thank you so much! Even though I was already informed about uthis topic, im sure it helped many People out there!

Great piece made total sense. Nice one... inflation though...hmmm...

Well explained! Thanks!

One of the best explainers I’ve read on this especially as someone who doesn’t know economics that deeply yet. Thank you!

Great job, guys! Would love to read more similar posts that explain complex things easily.

great article, just fyi there's a duplicate paragraph

"The Fed, being a government agency, is mandated to do what's good for the country.."

Thre is an informative video by @satmojoe if the economic system changes to leverage capped cryptocurrencies without the government owning the economic system.

отд