CAC Payback Period: The Key to Measuring ROI

As a software or SaaS business, it's crucial to grasp the perplexing concepts of Customer Acquisition Cost (CAC) Payback Period and the Lifetime Value (LTV): CAC Ratio.

These metrics offer a glimpse into the well-being and efficacy of a business, serving as a basic element in a comprehensive framework that enables corporations to make informed decisions concerning their marketing endeavors, product innovation, user acquisition costs, and customer retention tactics.

The relationship between these metrics can be pretty technical, and a deeper understanding can greatly enhance the success of your business.

What is a CAC payback?

The notion of CAC reimbursement is centered around determining the duration of time required for a corporation to recover the costs it incurs in acquiring new customers.

The term "CAC" refers to an indicator that quantifies the expenses incurred in securing a fresh client, including the outlays associated with sales and marketing channels aimed at attracting and transforming potential clients.

The CAC reimbursement period calculates the number of months or years needed for the typical customer's revenue or profit to offset the CAC expenses.

This metric is crucial for up-and-coming enterprises and expanding businesses as it offers insights into their customer acquisition approach and whether their investment in acquiring customers is yielding lucrative returns.

A CAC reimbursement period that is shorter in duration indicates a more efficient customer acquisition methodology and a more resilient business model, whereas a prolonged reimbursement period and breakeven point may indicate the need for reevaluating and enhancing the customer acquisition approach.

Who Uses the CAC Payback Period?

The CAC payback period calculation is useful for numerous firm stakeholders:

-

Entrepreneurs and founders: The CAC payback period can help entrepreneurs and founders evaluate their customer acquisition approach and discover areas for improvement.

-

Investors: Investors use the CAC payback period to determine a company's ROI and growth sustainability. Investors want a shorter AC payback period because it shows that customer acquisition investments are paying off.

-

Sales and Marketing Teams: Sales and marketing teams can analyze the efficacy of their customer acquisition activities and prioritize actions to shorten the CAC payback period and increase customer acquisition strategy efficiency.

-

C-Suite Executives: CEOs, CFOs, and CMOs use the CAC payback time to analyze company performance, make strategic decisions about customer acquisition efforts, and raise additional capital for growth-driving activities.

-

Financial Analysts: Financial analysts utilize the CAC payback period to evaluate financial performance and offer recommendations in terms of investments or the company's pricing strategy. Analysts prefer a shorter CAC payback period since it demonstrates a strong return on customer acquisition efforts.

The CAC payback period represents one of the key metrics for assessing a company's customer acquisition activities' performance and sustainability.

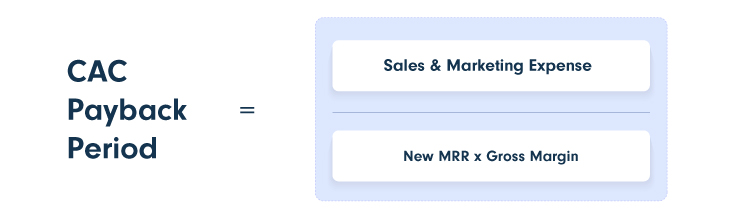

How to calculate CAC

The computation of this reimbursement period is accomplished via the following CAC payback period formula: CAC reimbursement period = CAC / (Average revenue per customer)

Where: CAC = Total expenses incurred in acquiring new customers (sales and marketing expenses)

Average revenue per customer = Total revenue generated by new customers divided by the total number of new customers

For instance, if a company incurs $100,000 in expenses on sales and marketing efforts to secure 100 new customers and the average revenue generated per customer is $500, then the CAC reimbursement period would be:

CAC reimbursement period = $100,000 / ($500 x 100) = $100,000 / $50,000 = 2 years

This implies that the company would require 2 years to recoup its investment of $100,000 in acquiring new customers, given that all other variables remain unchanged.

It is imperative to emphasize that the CAC reimbursement period is merely one metric to gauge the efficiency and effectiveness of the customer acquisition strategy. Whatever result the CAC Payback calculation gives you, be sure to analyze it in conjunction with other metrics such as lifetime value, churn rate, and customer lifetime revenue to attain a comprehensive understanding. Also, track it periodically to asses new operational costs, if there are any, as well as marketing and sales efficiency.

What is a typical CAC payback period?

A "normal" CAC payback period varies by industry, which is really why there aren’t any actual CAC payback period benchmarks. Technology and pharmaceutical businesses, which have significant client acquisition expenses, may have longer payback periods. E-commerce and consumer items have reduced customer acquisition expenses, so payback periods may be faster.

The growth stage might also affect CAC payback. Early-stage startups may have higher CACs to rapidly acquire customers. Maximizing customer lifetime value may cut CAC and lengthen payback as the company matures.

The CAC payback period varies on the industry, target market, product or service, and client acquisition approach. Companies must assess their CAC payback period and decide based on their conditions.

5 Effective Ways to Reduce the Payback Period

To shrink the CAC payback period and foster a more successful customer acquisition approach, companies can take advantage of various optimization techniques:

1. Streamline Marketing Expenditures

Analyze your marketing budget to guarantee that your resources are directed to the channels and methods that generate the greatest return on investment. This may involve redirecting resources from less productive channels to more fruitful ones or investing in technology and tools to automate and simplify marketing activities.

2. Elevate Conversion Rates

Increase the conversion rate from leads to paying customers by streamlining sales and marketing procedures and enhancing the user experience. This may include upgrading the design of your website, simplifying the purchasing process, and investing in sales enablement resources and training.

3. Decrease Customer Attrition

Minimize the number of customers who discontinue using your product or service by enhancing the customer experience, offering better support and customer service, and addressing any pain points or dissatisfaction.

4. Raise Average Revenue per Customer

Boost the average revenue generated per customer by offering premium products and services, cross-selling, or up-selling to existing customers.

5. Prioritize High-Quality Leads

Focus your sales and marketing endeavors on high-quality leads that are more likely to convert to paying customers instead of investing time and resources on low-quality leads.

By implementing these optimization strategies, companies can shorten the CAC payback period and enhance the power of their customer acquisition approach. However, it's crucial to continuously re-evaluate and adjust these strategies as market conditions, customer behavior, and competitive dynamics evolve over time.

Discover the challenges entrepreneurs face while calculating the payback period and their solutions on PayPro Global's Blog.