The emerging startup

playbook

Eight learnings from the next generation of software

Eight learnings from the next generation of software

Over the past year I’ve unpacked the zero to $1 million journeys of more than a dozen breakthrough startups including 11x, Attio, Copy.ai, lemlist and Pinecone. And I’ve advised countless others during this messy period between having a product to sell and a repeatable go-to-market machine.

Many of these startups have seen breakout growth. Copy.ai started with four MVPs, then struck gold and scaled to 10 million users in only four years. Jam went from seven failures to 10x usage growth. Pinecone saw signups explode to over 10,000 per day.

Not one of these journeys was preordained. And none followed what I’d consider to be the “conventional” startup playbook popularized over the past decade or so.

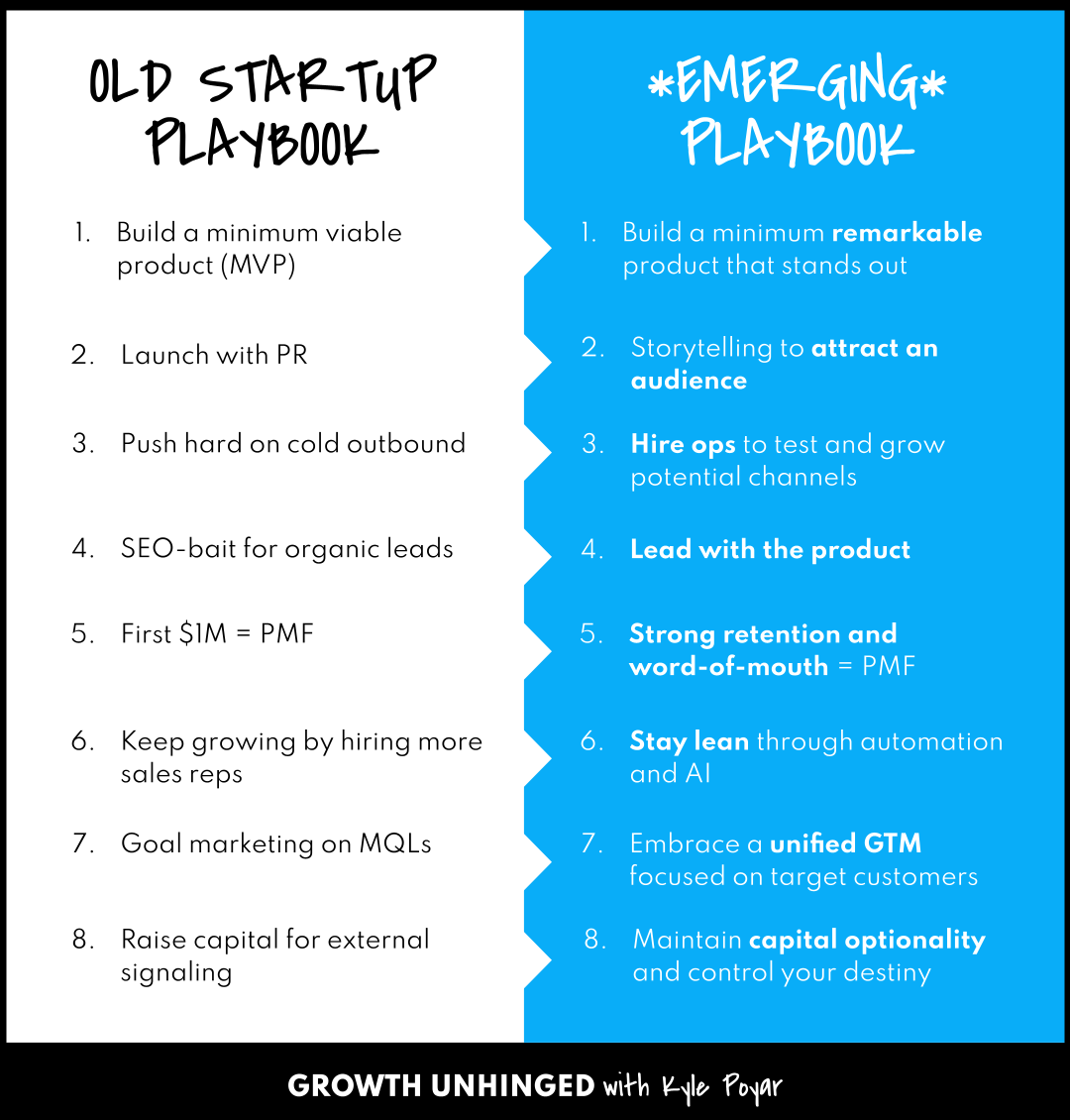

The conventional approach tends to look something like this:

Build a minimum viable product (MVP)—you should be embarrassed otherwise you’ve shipped too late.

Launch with a big PR splash—open your waitlist all at once to capitalize on the lightning strike.

Push hard on cold outbound to prove you can spend money to make money.

Write SEO-bait content for inbound leads—volume is what matters even if it is uninspired.

Get to $1M in ARR to show product-market fit (PMF) and raise your Series A.

Keep growing by hiring more reps—growth is an equation based on the number of ramped reps, quotas and average attainment.

Goal marketing on qualified leads (MQLs) to feed the army of sales reps.

Raise more money for external signaling—fundraises generate PR, close candidates and prove viability to prospects.

Each of these components makes intuitive sense. And collectively this playbook has served many startups quite well.

But the startups I’ve been spending time with lately — and in particular the startups that have gotten off the ground in a post-ZIRP, AI-first environment — have followed a different path. I’ll unpack what these next generation startups did instead, which collectively looks like an emerging startup playbook. This is a work-in-progress; please chime in with your reactions in the comments or on LinkedIn.

The emerging startup playbook

1. Build a minimum remarkable product that stands out

People used to tell founders that they should be embarrassed by their initial product; otherwise, they’ve shipped too late.

That was fantastic advice when the predominant alternative was pen-and-paper or Excel. Now the alternative is mostly other modern software products.

It’s increasingly easy to build software and increasingly hard to distribute it. It’s especially hard to distribute a product that isn’t ready for primetime. Once you lose someone’s trust, it’s nearly impossible to win them back – let alone ask them to share your product with a friend.

Jam co-founder Dani Grant saw this first-hand. It took Jam 18 months and seven failed launches before the eighth finally worked. What changed on attempt number eight? Waiting until the product was bulletproof.

“People say if you're not embarrassed by your v1, you've shipped too late. People told us to ‘just ship’ because you’ll know you have PMF when people are even willing to use a broken product.

This is outdated advice. Today, quality is non-negotiable. We didn't ship until the product was bug-free. This made a huge difference in early usage.”

- Dani Grant, co-founder and CEO of Jam

There’s still room for minimum viable product (MVP) frameworks, it’s just that the bar for “viable” is much higher than before. There needs to be something remarkable about the initial product, which sparks interest, word-of-mouth and ongoing usage even if the product isn’t at full feature-parity yet.

2. Embrace storytelling to attract an audience

Many startup founders stay in ‘stealth mode’ and steadily build up a waitlist until they’re ready to launch. Then the launch becomes a ‘lightning strike’ moment with as much fanfare as possible. Folks will open their waitlist all at once, work with PR to offer exclusives to top publications and drum up interest in early adopter communities like Product Hunt

Launches are energizing, catalyzing moments. But PR and big launch events can be expensive and reach the wrong audience–usually early-adopters and tire-kickers. They can easily backfire, wasting precious leads and leaving a startup scrambling when the sugar-high wears only weeks later. And many early-stage products aren’t ready for that level of overnight attention; sales and customer support aren’t appropriately sized to manage the demand, either.

An alternative would be to steadily build an audience interested in your product and to ungate the waitlist in batches. Building an audience is increasingly achievable through social media along with owned channels like newsletters. Unlike PR, these channels are person-centric rather than brand-centric; they require personality and authenticity in order to break through. Put differently, these channels reward founder storytelling to build an audience.

Adam Schoenfeld started Keyplay in March 2022 to help modern B2B companies succeed with ICP marketing. But six months before that he started with content and community to build an audience. Specifically, he published free data-rich resources for go-to-market leaders via LinkedIn, which he then converted into newsletter subscribers. This audience accelerated Keyplay’s growth by bringing signals on what to build first, instant credibility for Keyplay and a built-in distribution advantage.

“Our eight pre-launch customers came without a single outbound call or investor referral. We didn’t even have a website for Keyplay. 100% were curious community members who engaged.”

- Adam Schoenfeld, co-founder and CEO of Keyplay

Small decisions and optimizations helped Adam rapidly build an audience, growing his list from zero to 14,000 in less than 18 months without paid ad spend. He posted on LinkedIn multiple times a week with insightful, zero-click B2B content (zero-click as in readers did not need to click out of the platform in order to get value). He’d then send a B2B SaaS analysis newsletter once a week. Along the way, he provided assets for all Keyplay employees to optimize their LinkedIn profiles and amplify their collective reach.

3. Hire ops to test and grow potential channels

Cold outbound became a part of the GTM playbook at nearly every enterprise software company. It might start with founders running their own outbound plays to find design partners. Steadily larger and larger teams would get built to turn outbound into a coin operated machine.

This was extremely effective – so much so that buyers became inundated with emails, cold calls and LinkedIn messages (and then stopped replying). The overall volume of outbound has ballooned; it’s harder and harder to make manual BDR/SDR teams economical, especially if a startup hasn’t fully honed its ideal customer profile (ICP) and messaging.

The flipside is that there’s an exploding number of potential channels to both generate and capture demand. A small subset of these include: organic social, paid social, automated outbound, AI SDRs, SEO, editorial content, lead magnets, influencer campaigns, field marketing, community marketing… the list goes on. There’s also more and better GTM technology to understand who’s in the target audience, collect signals about their buying intent and then reach them with a personalized message in an automated way.

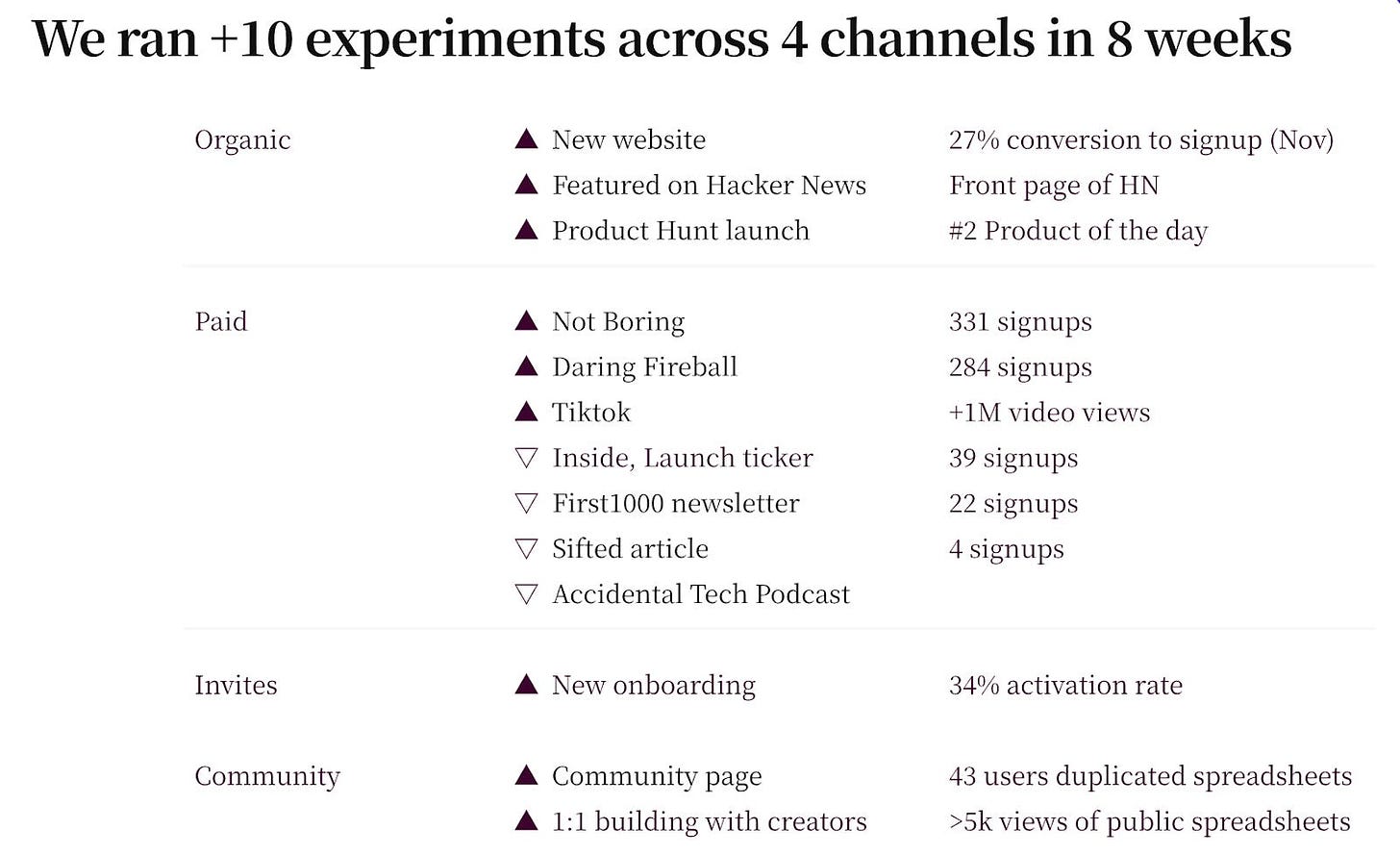

The next generation of startups takes a rigorous approach to identifying potential channels, testing them and then scaling the handful that work best. Rows, the next generation spreadsheet company, ran 10 experiments across four channels in eight short weeks before scaling the channels that worked best. This requires an operational skill set usually in the form of a generalist (think: chief of staff) who is intellectually curious, analytical and fast-moving.

Rows took a rapid experimentation approach to test new channels

4. Lead with the product

When startups wanted to supplement their lead generation beyond outbound, they’d typically turn to search engine optimization (SEO). The SEO playbook usually included creating a list of potential keywords, prioritizing the relevant ones that had the most volume and then writing lots of SEO-bait content to rank for those terms.

We’ve all stumbled across this highly generic and, frankly, unusable content. And AI is poised to create far more of it. (I sometimes wonder if the primary audience for SEO-content is now other AI bots rather than in-market buyers.)

A fresher approach is to create valuable experiences that draw people in. It comes down to leading with the product as its own marketing through lead magnets, mind-blowing videos, interactive demos or free products.

Copy.ai – the AI platform for go-to-market teams – took the approach of creating free lead magnets, inspired by HubSpot’s blog title generator and Shopify’s business name generator tools. They built more than 30 of these, which attracted a substantial number of users. Copy.ai uses AI to generate the tools themselves along with descriptions of the tools, landing pages to promote them and examples of inputs and outputs. The company has scaled from zero to 10,000,000 users in only four years.

Rows, meanwhile, captured lightning in a bottle by removing their homepage altogether. They let users immediately try the product – no signup required (users create an account later when they wish to save their progress). The project was a resounding success. Leading with the product nearly tripled Rows’ conversion rate from visitor to signup (from 11% to 27%) and quintupled the number of new activated users.

5. Strong retention and word-of-mouth = PMF

$1 million ARR has long been a major milestone in enterprise software. Whether in fundraising conversations or popular blog posts, $1 million comes up as a near-mystical number that signals product-market fit and readiness to raise a Series A.

It’s not a terrible rule-of-thumb. The $1 million ARR milestone indicates customers are willing to pay for the product and that there’s some level of repeatability in finding, winning and serving these customers. It might have been particularly meaningful at a time when go-to-market was dominated by cold outbound plus inside sales.

But $1 million ARR was never a great indicator of product-market fit, and is even less useful today. Why? A software company could get to $1 million ARR with one big enterprise deal or with thousands of small, self-serve customers. Customer cohorts could go through numerous renewal cycles or none at all. And the use cases could be extremely consistent across customers or barely related.

The founders I’ve talked to look at retention and word-of-mouth as stronger indicators of product-market fit. These signal that customers are seeing repeatable value and that the value is so strong that they’re telling others about it.

Attio, the up-and-coming CRM, spent nearly five years building and iterating before gaining conviction that they had product-market fit. Co-founders Nick and Alex paid special attention to the ratio between daily active users (DAUs) to monthly active users (MAU). This helped Attio understand the product’s stickiness and how many people actually wanted to use it.

“If a user hates a tool, they’ll cram their usage into one short burst, whereas if they love a product, they’ll engage in small bursts throughout the day.”

- Alexander Christie, co-founder and CTO of Attio

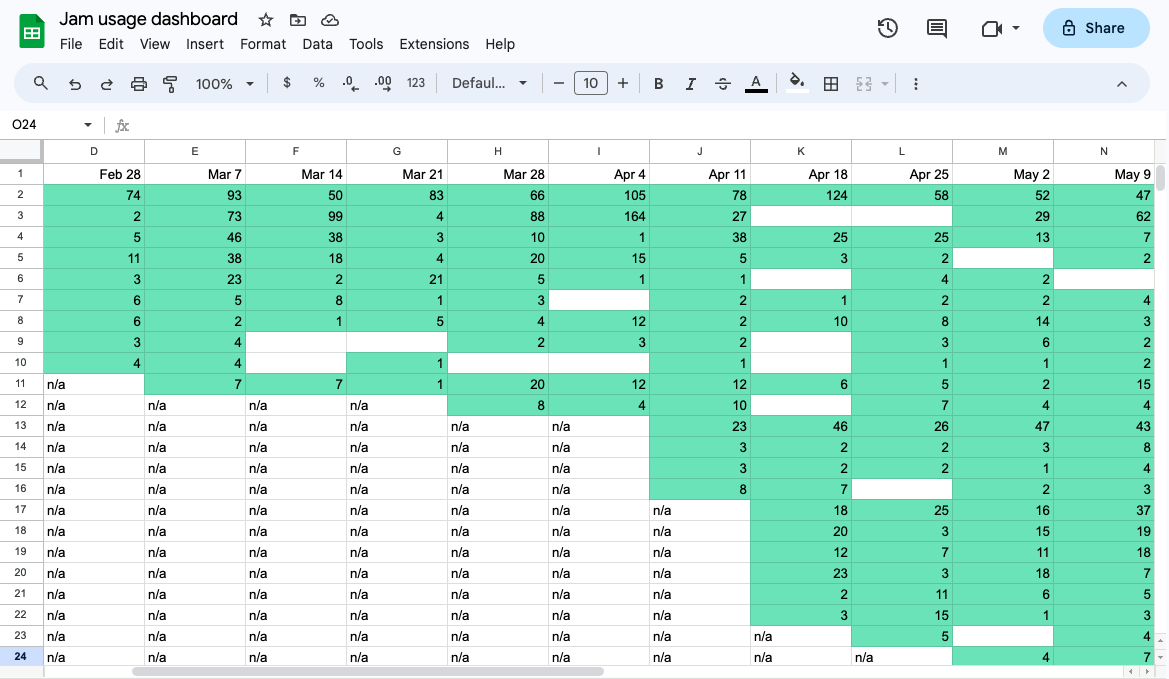

Jam, the bug reporting tool, tracked one north star metric in the early days: retention. Dani wanted to see customers continue to use Jam week after week.

“You can't fake retention. If a product is not useful, you don't retain. Our team tracked usage in a simple Google Sheet and watched for streaks week over week. Only once retention was healthy did we open up Jam to the public.

When we were 19 weeks in, two of the original five pilots had 19 week sprints. Finally, 20 weeks after the pilots and more than six months after starting work on v8, we were ready to launch.”

- Dani Grant, co-founder and CEO of Jam

Jam tracked product usage and watched for streaks week over week

6. Stay lean through automation and AI

In a previous era, growing beyond $1 million ARR became more-or-less an equation in a spreadsheet. If you didn’t grow as fast as you hoped, it was usually because you hadn’t hired enough people quickly enough.

The spreadsheet-based approach to scaling has started to fade as go-to-market becomes more complicated and as startups embrace more efficient growth. An increasingly important metric in the minds of both founders and investors is annual recurring revenue (ARR) per full-time employee (FTE); and there’s a much higher bar for efficiency than before.

HeyGen co-founder and CEO Joshua Xu underscored this point; the company scaled quickly to a reported $35M in ARR (and profitable) with an extremely lean team. Even though HeyGen certainly has the capital to hire (they raised a $60M Series A in June 2024), Joshua told me the following:

"More people isn't always better. A lean team that can move fast is more important."

- Joshua Xu, co-founder and CEO of HeyGen

At the same time automation and AI give software companies the tools to do more with less. They might not need as many SDRs per account executive if they can automate the SDR function or replace SDRs with AI. They might not need as many marketers if they leverage AI for content creation, personalization and SEO. And there might be less reliance on account executives to sell small deals when customers might happily buy via self-service.

Paris-based CRM provider folk recently celebrated 2,000 paying customers, over 100,000 users and 5x year-on-year revenue growth – all with a lean team of 25 people. There’s only one growth person, marketer and SDR on the team. Co-founder and CEO Simo Lemhandez believes that early decisions on team structure have a big impact on a company’s future; the unit economics essentially get ingrained as a company scales. That’s influenced him to keep folk extremely lean with a high ARR per FTE.

“We try to be slightly stretched so that we either automate stuff or solve it in a product-first way rather than thinking that hiring a new person will always solve the problem. There’s a strong constraint we impose on ourselves not to hire too fast and to not consider hiring as the only solution to solving a problem.”

- Simo Lemhandez, co-founder and CEO of folk

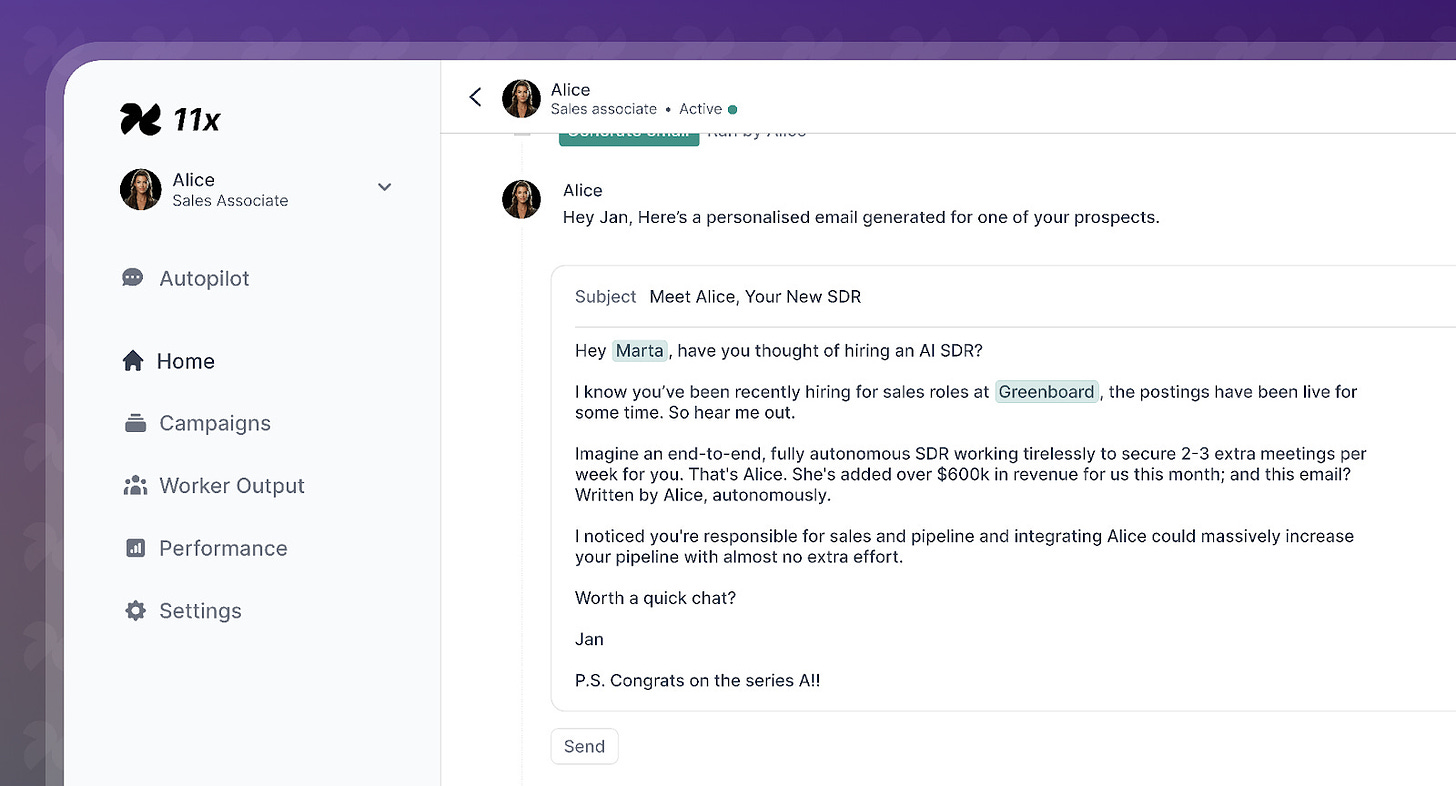

AI SDR startup 11x takes a similar approach, benefiting by being able to dogfood their own product. The company’s explosive revenue growth came from one main channel: Alice, the virtual SDR, which generates 60-80 qualified meetings per AE each week. Alice scans for companies that have intent (those who are hiring SDRs) and reaches out to the target buyer with a personalized message like the one shown below. This isn’t spray-and-pray outbound, it’s lower volume and higher quality through AI.

“You need to personalize and have relevance in a scalable way, which is becoming increasingly easy. Instead of having someone spend 20 minutes researching the person and the content they wrote, AI can do that very effectively.”

- Hasan Sukkar, founder and CEO of 11x

11x’s AI SDR puts personalized outbound on auto-pilot

7. Embrace a unified GTM focused on your ideal customers (ICP)

Software businesses have been stuck with a mental model where marketing generates leads (MQLs) and then sales closes them. As we tied growth to a hiring plan, marketing became responsible for feeding new sales reps with more and more MQLs.

In my view, this MQL paradigm is fundamentally broken, and not just because the very definition of a marketing qualified lead is highly subjective and arbitrary. Measuring MQLs makes it nearly impossible to know whether our efforts are influencing the right people at the right accounts. It sets up attribution fights and blame games between marketing and sales. It encourages spray-and-pray demand generation tactics — with the logic that we can disqualify or filter out anyone who’s a bad fit. And it creates a leaky lead bucket with significant wasted effort and spend.

As ClickUp COO Gaurav Agarwal told me, revenue needs to be treated like a repeatable machine. The focus should be on understanding the incrementality of what you’re doing rather than attribution.

“Revenue machines in B2B are changing very fast and are becoming more holistic than ever before. Especially in a PLG environment, there is no single revenue owner!”

- Gaurav Agarwal, COO of ClickUp

Why not focus your efforts on reaching the accounts you care about where your product works the best, you have the best chance of winning and where customers are most likely to renew and expand? And why not embrace a view that every team plays a role in generating pipeline?

If you’re ever going to find out what works, you need a unified view of go-to-market (GTM) effectiveness: (a) how many accounts are in your ICP?, (b) where are those accounts in their buying journey? and (c) which activities work best to influence accounts along that journey?

If you look at GTM effectiveness this way, it doesn't matter whether you invest more in PLG, automated outbound, SEO, paid ads, BDRs/SDRs, or something else entirely. What matters is that you reach the right people and turn them into customers.

8. Maintain capital optionality and control your destiny

To pull off the prior startup playbook, you’d need capital – the more, the better. Large fundraises not only provided the cash to hire armies of sales reps and xDRs, they provided powerful external signaling. Fundraises attracted press attention, which then attracted candidates and signaled viability to potential prospects. There were competitive dynamics at play, too, which big fundraises effectively taking the oxygen out of the room as smart VCs anointed a category leader.

This was fantastic – until it wasn’t. As interest rates rose and the capital markets froze, many found themselves with giant preference stacks and valuations that would be impossible to grow back into.

If you’ve read this far, you’ve probably noticed the emerging startup playbook is far less reliant on outside capital. Software companies attract their own audiences, grow efficiently through automation and AI, and scale up as they’ve observed strong evidence of product-market fit.

Outside capital becomes optional and at the founder’s discretion depending on their specific ambitions and perspective on the market. Founders may choose to bootstrap (see: lemlist bootstrapping to $28M ARR) or raise right-sized rounds that provide the fuel to go after an opportunity they see in the market. Or they might choose to go big to capitalize on the opportunity in front of them (see: HeyGen raising a $60M Series A while profitable). In either case, it’s about embracing optionality and having a path back to profitability if and when desired.

The TL;DR

Altogether, there are eight traits that I’m observing in the next batch of breakthrough software startups:

Build a minimum remarkable product that stands out

Embrace storytelling to attract an audience

Hire ops to test and grow potential channels

Lead with the product

Strong retention and word-of-mouth = PMF

Stay lean through automation and AI

Embrace a unified GTM focused on target customers

Maintain capital optionality and control your destiny

Think of these as emerging best practices rather than a how-to guide. Some may not work for your specific business; you may also find yourself creating entirely new practices that better reflect the nuances of your product, market and team.

Regardless of where you land, it’s clear that we need to move past the dated (and expensive) approach of the recent past and craft a better future.

PS - If you’re building a startup following these principles, I’d love to hear from you. Simply hit reply or connect on LinkedIn.

Special thank you to Adam Schoenfeld (Keyplay), Alexander Christie (Attio), Dani Grant (Jam), Guarav Agarwal (ClickUp), Hasan Sukkar (11x), Henrique Cruz (Rows), Joshua Xu (HeyGen) and Simo Lemhandez (folk) for sharing your insights!

This article was originally published here.

This captures a shift many founders feel but struggle to articulate: quality over speed, distribution over hype, retention over vanity metrics, and optionality over forced fundraising. The emphasis on minimum remarkable products, product-led growth, and staying lean with AI feels very aligned with the post-ZIRP reality. Especially liked the reframing of PMF around retention and word-of-mouth rather than ARR milestones. This feels less like a playbook and more like a mindset for building durable companies.

This really hit for me. The “ship fast or you’re doing it wrong” advice feels a lot less true than it used to.

I’m building something small right now, and the hardest part hasn’t been speed — it’s deciding what not to ship yet. Once people try something, their first impression sticks, and it’s hard to win back trust if it feels half-baked.

The idea of a “minimum remarkable” product makes way more sense in that context. Even early on, it has to feel intentional.

I also liked the point about storytelling vs big launch moments. Feels like building in public and letting people follow along is way more sustainable than trying to manufacture a big spike.

Curious how others here think about that balance — how do you decide when something’s ready enough to put in front of real users?

Great breakdown of the modern startup playbook. I particularly resonate with the focus on 'problem-market fit' before scaling.

I’m currently in the validation phase of a minimalist SaaS—building a web-based organization infrastructure for moving and storage. One thing I’ve noticed is that users are becoming 'app-fatigued.' They don’t want to download a new app for a one-time life event like moving house.

Transitioning from a 'product' to an 'ecosystem' that values speed and data privacy (especially for the EU market) seems to be the leaner way to go in 2026. Thanks for sharing these insights!

Hi , i m a fullstack developer , with 3 years of exp , i use react , django, nodejs, i built 2 fullstack projects , and i m ready for remot work .

Interesting read. Thanks for sharing.

What is your take on an MVP which is not really a product. A smoke test or a fake-door website that validates people are willing to pay X dollars a month by viewing a website with a product demo (that does not exist yet). Of course, the visitors are not charged, but are informed they are added to a waitlist as soon as they register (and before providing credit card details).

In my experience, this can create a lot of value before you build a product (regardless if you are embarrassed of it or not).

But what's next after product launch? What strategy you use for marketing?

Ive been working with WordPress plugin founders for about 10 years now and your insght on shipping a remarkable product is spot on. First impressions matter so much and are where the real adoption opportunity lies, not just in getting any old thing out there. Thanks for this!

Great read! I think a lot of people confuse getting feedback with launching a product. When trying to launch a product it can be hard to know where to start. I often find it best to pick one feature of product to share and get feedback on. If the core feature gets traction then move on to building out your product, making it look good, and launching.

I completely agree, Dmitry! 🎉 Focusing on one core feature can really streamline the feedback process and help gauge interest before diving deeper into product development. It’s a smart way to minimize risk and ensure you’re building something that truly resonates with users. Once you validate that initial feature, it becomes much easier to expand and enhance the product. Your approach aligns well with the idea of iterative development, which is so crucial in today’s fast-paced environment! 🚀

I have an idea. I think it could be a GREAT one. But my issue is, I have no idea where to start when it comes to startups. My idea is an app. Want to know what I know about SE and app development? Nothing. I came across this website for resources like this. I find this playbooks helpful but im still at square -2. I cant post on this platform yet since I am new. But I want insight, I want help.

You're not alone, as most of us showed up here at "square -2" with nothing but an idea and some curiosity. You don’t need to know software engineering to start. The real first step is understanding who your app is for and what specific problem it solves. Talk to real people who deal with that problem, ask how they handle it now, and see where the frustration is. From there, sketch out your idea, even if it’s just on paper, and look into no-code tools like Glide or Softr to build a simple prototype. You’d be surprised how much progress you can make without touching code. Even though you can’t post yet, commenting like this is exactly how to start building momentum. Keep showing up, ask direct questions, and don’t be afraid to share your progress.

That’s reassuring to hear... I definitely feel like I’m at “square -2” but the vision is clear.

Your exploration of the evolving startup landscape is both refreshing and thought-provoking. The emphasis on building a "minimum remarkable product" and the importance of authentic storytelling truly resonates. It's fascinating to see how today's startups are redefining success in a more dynamic and competitive environment. Looking forward to hearing more about your emerging playbook!

IS IT POSSIBLE TO RECOVER LOST CRYPTO? YES, ONLY HACKANGELS

Hey, my name is Frank, and I'm a crypto trader! I just wanted to share my incredible experience with The Hack Angels. They are truly exceptional when it comes to crypto recovery. They managed to recover my lost $1.7 million worth of Bitcoin from a scam, which I honestly thought was impossible. If you ever find yourself in a similar situation, I highly recommend reaching out to them.

You can contact them through their hotline at +1 (520) 200-2320 (available on phone/WhatsApp)

If you're in London, you can even visit them in person at their office located at 45-46 Red Lion Street, London WC1R 4PF, UK. They're super helpful and really know their stuff! Don't hesitate to reach out if you need help!

THANKS TO THE SERVICES OF THE HACK ANGELS // FOR HELPING ME RECOVER MY USDT AND BTC

I lost almost $698,000 in a bitcoin investment scam a few months ago. I was devastated and depressed, and I didn’t know what to do. When I saw a favorable review of THE HACK ANGELS RECOVERY EXPERT. I decided to contact them and voice my concerns. God is so good that I am a living testament to the fact that there are still legitimate recovery hackers out there. I will confidently recommend THE HACK ANGELS RECOVERY EXPERT to everyone I meet. I will suggest them to anyone who falls victim to any kind of online scam by using the information below.

WhatsApp; +1(520)-200,2320

If you’re in London, you can even visit them in person at their office located at 45-46 Red Lion Street, London WC1R 4PF, UK.

Unreal overview article! Very insightful and helpful to where I am attempting to head.

would love to read an article about how to find the first 10 paying customers and which channels are the best!

Report all your scam cases to Trust Geeks Hack Expert. They're a professional recovery company with a team of experienced and certified professionals who will help you trace the source of the transaction and recover your money for you. As long as you have the evidence of payment,

Huge breakdown, Thanks for sharing!

Love this breakdown, Kyle. I'm in the middle of soft launch for my own platform (Norte — helps travelers instantly see what coverage they already have from their credit cards) and the “minimum remarkable product” point really resonated.

I skipped the “blitz launch” playbook and started with my personal network on LinkedIn ( no ads, no PR so far) just storytelling and direct signups. Even without a big public launch yet, I’m seeing my network reaction and work form there.

Curious for others here: have you found that starting smaller, with a tighter audience, actually sets you up for a stronger public launch later?

Nice insights! I'm a newbie here and found your content very thoughtful. Thanks for sharing!

I love the part about building something remarkable and leaning on storytelling instead of just following the old cold outbound → sales team ramp cycle.

In healthcare software, you can’t just “ship something quick and fix it later.” A buggy release can literally impact patient care. I’ve seen this play out with hospice and home health agencies that adopt modern, well-integrated systems early. One example is Alora — their platform is purpose-built for agencies, and they’ve baked in compliance tools like the HOPE assessment in a way that feels seamless for nurses but still delivers the data surveyors want to see. That’s the kind of “minimum remarkable product” healthcare needs, something polished enough on day one to win trust, but still able to evolve.

It also echoes your point on strong retention and word-of-mouth. In healthcare, once a system proves it makes charting easier, keeps everyone connected, and passes surveys without drama, it spreads fast in tight-knit agency networks — no massive ad spend needed.

Curious if others here are seeing the same shift in their industries where trust + retention beat “blitz and burn” growth.

I'm currently building a platform/startup and still working on the MVP. My main struggle is that the core idea of the product already has a certain level of complexity, and I'm finding it hard to simplify it enough for an MVP. As a result, what I’m calling an MVP is already feeling a bit too complex...

Has anyone else faced this? How do you deal with it and find the right level of simplicity to launch?

Loved this piece, Kyle.

We're building in a very unsexy industrial niche (acoustic engineering), and the idea of a “minimum remarkable product” vs. MVP is exactly how we’ve been thinking lately — especially when trust and credibility are everything.

Also big yes to ditching the SEO-bait and outbound spam cycle. It’s noisy out there (pun intended), and authenticity + product-led storytelling feels way more durable.

Thanks for putting this together — one of the few playbooks that actually reflects how things work now, not five years ago.

Incredible breakdown. This explains why 80% of the launches I analyze fail.

They're still following the 2019 playbook in a 2024 world.

Three patterns I see constantly:

1. MVP Trap: "Ship and iterate" worked when competition was Excel. Now it's other SaaS products. Quality bar is 10x higher.

2. MQL Obsession: Founders optimize for vanity metrics instead of retention. I've seen companies with 10K MQLs and 5% retention.

3. Capital Dependency: Raised big rounds, hired fast, burned through cash. No path to profitability.

The companies that survive follow this new playbook without realizing it.

Attio's DAU/MAU ratio approach is brilliant. Simple metric that cuts through the BS.

Kyle - have you noticed any correlation between which founders adapt to the new playbook vs. those who stay stuck in the old one?

Seems like it requires a fundamental mindset shift from "growth at all costs" to "sustainable value creation."

Really appreciated this breakdown, especially the shift from MVP to MRP (minimum remarkable product). I’m building something for early-stage founders right now, and this helped me rethink how I’m shipping vs. how I’m signaling readiness. That line about losing trust early and never getting it back really hit.

I'm curious: when working with founders who don’t yet have traction or an audience, how do you recommend they balance “build in public” storytelling with the risk of overexposing a product that’s not yet there?

Thank you for this article. very insightful!!

Love your insights--I'm a newbie in the startup space and found your article very helpful. Added to bookmarks!

Needed this

This was a great read! Minimum remarkable product for sure resonates with me deeply. I've been battling internally with putting out a half-baked product just for the sake of saying it's out there and it "works". But I knew it wouldn't show the full capability of what my SAAS has to offer!

Love this... actual market fit is the best driver for all of these

Great insights honestly- My concerns really is based on the scaling and being limited on a marketing standing point- Although fully Market-FIt what is the best way you can get funded for scaling while keeping autonomy and a low interest rate?

This is what we keep in bookmarks

This is spot on. Most startup advice still feels stuck in the VC-fueled 2010s. The new wave isn’t about raising big or hiring fast. It’s about staying lean, building something people actually want to use every day, and scaling only once retention proves it’s real. Good to see the focus shifting back to fundamentals.

Very helpful!! it answered a lot of my questions!

Really appreciate you sharing your lessons. My biggest takeaway: use some small tools to lead the traffic to your product(consider Shopify and hubspot) . I am going to focus on using ai to develop my first small tool to receive some early users! Thanks!

So much here to ponder. Thank you.

As it relates to the MVP, in today's marketplace, viability means your product stands out in a crowd and stands up to your users' initial expectations. That's exceptionally hard to do for a startup, but that seems to be the bar.

Great post! I like the idea of building a minimum remarkable product instead of just an MVP. With all the AI tools now, it's easier to build stuff. And there are so many SaaS products out there, so quality really matters if you want to stand out.

Great read. Right now, we're in the phase of getting user feedback as well. Integral HQ. It's a new online community platform. Its interesting to see here how often people use these comments, the feedback, etc!

nice, bookmarking for later

Someone once said an MVP is not the basic form of a product that works, but the basic form of a product that people are willing to pay for. I resonated with that.

This really encapsulates the AI age of building a startup. Perhaps soon this will become the holy guide for future startups

This is a brilliant article that encapsulates many of my initial thoughts regarding company formation. In this new ecosystem, a lot of the advice on how to become a successful founder is less relevant, especially your point about MVPs.

This article highlights a crucial shift in startup growth strategies—from aggressive scaling to a leaner, more sustainable approach. The focus on a Minimum Remarkable Product (MRP) over a basic MVP reflects rising user expectations. Building an audience through storytelling, leveraging AI for efficiency, and prioritizing sustainable growth over excessive funding are key takeaways. Instead of hiring aggressively, startups are now automating and optimizing, ensuring long-term viability. This new playbook feels better suited for today’s competitive, capital-conscious environment.

This is a brilliant article, it articulates a lot of the thoughts I’ve had in the early stages of founding a company. A lot of the advice outlining the “secrets” of becoming a successful founder are less relevant in this new ecosystem - especially the point you make about MVPs

Thank you for the concise post! Any feedback on what attributes would make a minimum product remarkable? Like "solves an old problem in a new more effective way"...?

Great post! I learned a lot out of it. From terminology to strategies. It has even provided some ideas. I wonder how it would work with non-software business ideas.

Great post, I have a deeper understanding of the product. I have some thoughts of my own and I'm not sure if they are correct. I think whether to choose "Viable" or "Remarkable" depends on the situation. If the product is in a very niche and vertical market, shouldn't an MVP be used first to validate the market rather than an MRP? However, if it is in a highly competitive market, an MRP is indeed necessary.

Wow, thank you for this great write up, I've really learned a lot and hoping to implement them. One key take for me is the importance of authentic storytelling. Once again Thank you

So much this breakdown lines up with what we’ve experienced in the home health space. I run a small agency, and we recently switched to Alora after trying a few of the usual "feature-packed" platforms that looked great in demos but created chaos in real life.

Alora works. It’s one of those products that clearly focused on being remarkable for a specific audience (agencies like ours), not trying to please everyone. Onboarding was smooth, documentation actually gets finished on time, and real-time error prompts cut QA hours in half. We heard about it from another agency, and now I’ve referred it to three more... that’s the kind of quiet word-of-mouth momentum you can’t fake.

This post nails the shift from growth-for-growth’s-sake to building something people actually want to use every day. Glad to see this thinking getting more attention.