The rise of cryptoequity. Startups ditch spreadsheets for tokenized

equity.

Trump’s executive order just changed the crypto game, letting startups pivot to tokenized equity from trading paper stocks.

Trump’s new pro-crypto order creates a massive ripple effect in the startup market.

Instead of old-school paperwork, founders can start using tokens for equity.

It’s risky, but if a meme coin can raise millions, imagine what real cryptoequity could do.

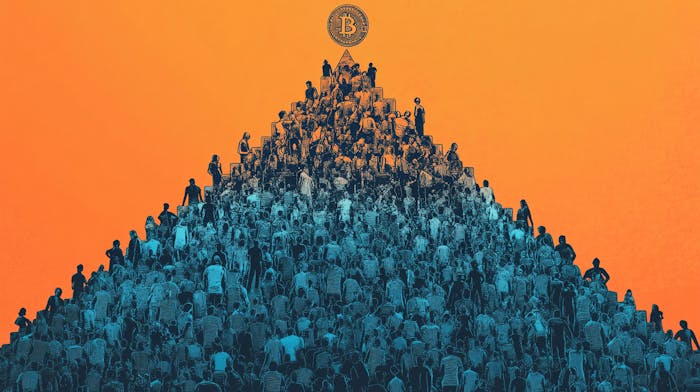

Ever since Bitcoin soared past $100K last month, the crypto hype has only intensified. With President Donald Trump’s new executive order setting the tone for friendlier crypto regulations, some startups are stepping it up and looking into raising cash through tokenized equity, aka cryptoequity.

In other words, they're ditching spreadsheets and jumping on the blockchain train. And if people like Balaji (ex-Coinbase CTO) are right, this could be the next big thing in startup fundraising.

For years, crypto startups faced unclear laws. Under the Biden administration, regulators like the SEC took action against crypto companies, arguing they violated securities laws. But everything has changed since Trump’s victory back in November. His win got a big boost from pro-crypto politicians and deep-pocketed crypto lobbyists.

On January 24, 2025, President Trump signed an executive order that flipped the script. Key changes include:

Protecting crypto companies’ access to banking.

Banning US central bank digital currencies (CBDCs).

Creating a federal task force to draft clear crypto regulations and explore a national Bitcoin reserve.

In short, this is the most crypto-friendly environment in US history. As Balaji puts it on X:

“If everything is now legal (in crypto), many startups will try raising funds by issuing tokens as explicit cryptoequity.”

In the traditional sense, startup equity is all tied up in paper stock certificates or spreadsheets. Cryptoequity changes that. Investors hold digital tokens in their crypto wallets. These tokens represent ownership, dividends, voting rights — everything traditional equity does, but programmable. And that isn’t just theoretical. Founders are already putting it to work in unexpected ways.

Remember Siqi Chen? The founder who raised $40M for his daughter’s rare disease research using a Solana memecoin? His story isn’t just heartwarming — it’s a blueprint. Chen’s MIRA token wasn’t equity — it was a speculative asset. But it shows the power of crypto’s global, 24/7 markets. Imagine applying that liquidity to actual startup equity.

Pros

Global reach: Why stick to a few angel investors or VCs when you can reach crypto investors all over the world?

Automation: Smart contracts handle vesting, dividends, and voting. No lawyers, no spreadsheets. As Balaji Srinivasan comments, “Code enforces lockups better than any legal doc.”

Community: Founders can hand out tokens to their most loyal users or customers. Additionally, using crypto this way can also attract crypto fans and help grow a stronger community.

Cons

Compliance still matters: The SEC/CFTC task force will clarify rules in 2025. Until then, work with crypto-savvy lawyers.

Volatility: Cryptoequity is volatile. Bitcoin prices can drop by 20% or more in just a few days. Such swings can disrupt your startup’s finances, so consider using stablecoins for payouts to maintain financial stability.

Hacks: Use audited platforms. A bug could drain your equity pool faster than a meme coin rug pull.

New era

Raising money is tough, but cryptoequity offers faster, more flexible funding with global reach. It’s unclear if mainstream investors will embrace it or if it’ll stay niche.

Right now, there’s optimism about a new era of cryptoequity, but much depends on upcoming regulations. For indie hackers, this might be the perfect time to reconsider token-based fundraising.

If a memecoin like MIRA raised millions for rare disease research, imagine what a well-planned cryptoequity launch could achieve.

We’ll update you as the rules take shape. This could be the biggest funding shift since crowdfunding.

Have a story, tip, or trend worth covering? Tell us at [email protected].

This is wild to watch unfold. Tokenized equity could actually make early-stage fundraising more accessible, but I think the real bottleneck is still onboarding. Most potential investors or even customers don’t want to touch crypto wallets, seed phrases, or exchanges just to grab a piece of a startup. That’s where platforms like moonpay are useful — they make it dead simple for non-crypto natives to get in the door with fiat. If cryptoequity is going to scale beyond the hardcore crypto crowd, smooth fiat-to-token rails are going to matter just as much as regulation.

Crypto startup equity is getting a glow-up—no more dusty cap sheets. Tokenized equity offers global reach, built-in automation, and programmable ownership. Risks? Volatility, hacks, and patchy regulations. But in today’s climate, this could level up fundraising like never before.

The crypto space is full of scams and unclear regulation. I'd be very careful trying to raise capital through token-based fundraising. However I love the idea!! Hopefully there will be serious players soon that can help bootstrapped startup founders with setting everything up so they can focus on the actual building instead of the fundraising part with cryptoequity.

Does anyone know a way to issue crypto equity?

wow

Trump’s new executive order has opened the door for startups to embrace tokenized equity, or "cryptoequity," allowing founders to raise funds through digital tokens instead of traditional paper stocks. This shift is fueled by the growing crypto market and the support of pro-crypto politicians, offering startups a global reach and automated processes via smart contracts for things like dividends and voting rights. However, while cryptoequity provides faster, more flexible funding, it also comes with risks like volatility, security concerns, and regulatory uncertainty. As regulations evolve, this could revolutionize startup fundraising, offering both immense opportunity and challenges.

Thanks for explaining easily.