Top 10 Managed IT Security Service Providers For Accounting and Tax Firms: The Best MSSP Vendors

Cyber threats against accounting and tax firms have never been higher. Between ransomware targeting CPA practices, stricter FTC Safeguards Rule enforcement, and the IRS Publication 4557 requirements, firms can no longer rely on piecemeal security measures or “best-effort” IT vendors.

For partners, COOs, and IT administrators, the question isn’t if you need managed security, it’s which provider you can trust before tax season hits.

This guide compares MSSP options for accounting and tax firms with a focus on Safeguards Rule and IRS Publication 4557 requirements. It is designed for firms with 5–200 seats that need audit-ready security, predictable compliance, and guaranteed uptime when deadlines matter most.

Every provider listed offers 24/7 monitoring or response capabilities, though coverage levels vary; confirm scope (endpoints, email, cloud apps) during scoping. And for CPA firms, the three must-have controls are MDR/EDR, phishing defense with training, and tested backups with rapid restore.

By the end of this article, you’ll have a clear, practical view of the top ten managed IT security service providers that understand the accounting industry and the knowledge to shortlist the right partner for your firm’s security and compliance needs.

Disclaimer: The details below are based on publicly available documentation as of 2025. Certifications, SLAs, and compliance scope should always be verified directly with each provider before engagement.

How We Chose These MSSPs (What Matters to CPA Firms)

Not all managed security service providers (MSSPs) are created equal—especially when it comes to the unique compliance and performance demands of accounting firms. Our evaluation framework focused on factors that align with regulatory requirements, firm workflows, and the realities of peak tax season.

Here are the criteria we used:

Compliance Alignment

Providers must show expertise with FTC Safeguards Rule and IRS Publication 4557.

WISP (Written Information Security Program) support and SOC 2 audit-readiness were prioritized.

Security Stack Coverage

Most listed providers offer 24/7 monitoring or response capabilities, though coverage levels vary. Some regional vendors provide on-call or outsourced after-hours support instead of a full in-house SOC.

We verified availability of MDR/EDR, phishing defense with training, and tested backups with rapid restore—the three must-have controls for CPA firms.

Accounting-Specific Fit

Preference was given to MSSPs that understand accounting workflows and support the software stack firms rely on (QuickBooks Desktop, Lacerte, Drake, CCH, Sage, etc.).

Scalability by Firm Size

Best fit providers were identified for firms with 5–200 seats, ensuring both small practices and mid-sized firms can operate securely with predictable costs.

Performance During Tax Season

Special weight was given to providers offering proven uptime and rapid response during January–April, when downtime is most damaging.

Support Quality

Round-the-clock availability and staff trained in accounting IT issues were favored over generic help desks.

By applying these filters, we narrowed the list to ten MSSPs that deliver both the regulatory confidence and operational resilience accounting firms need in today’s threat landscape.

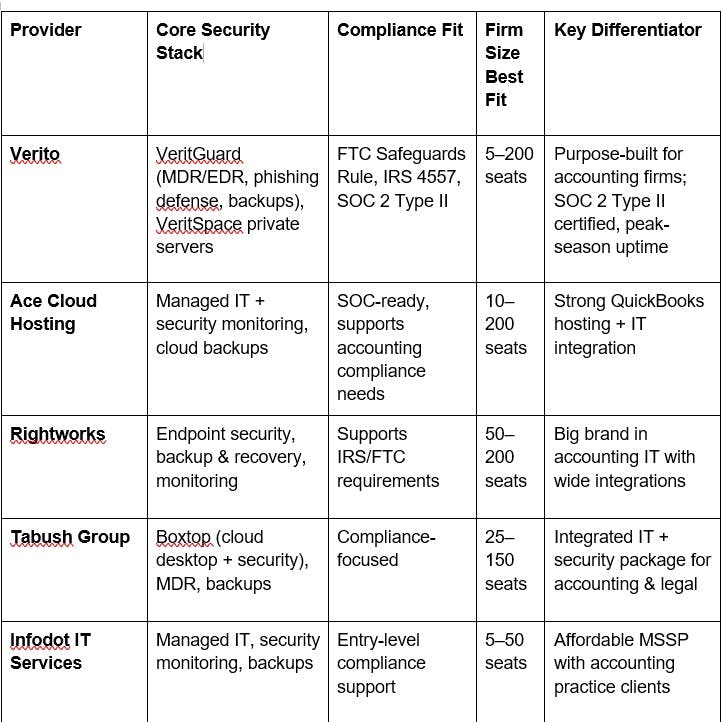

Quick Comparison Table (At-a-Glance)

Best MSSP Vendors

1. Verito

Most MSSPs build for every industry and then try to adapt their stack for accountants. Verito flips that model, it’s designed only for tax and accounting firms. That focus shows up everywhere: in the security controls, the way servers are configured, and even in the support desk conversations.

What You Get with Verito

VeritGuard handles the security essentials accountants can’t compromise on: MDR/EDR for endpoints, phishing defense combined with staff training, and backups that are tested, not just promised.

VeritSpace runs your QuickBooks Desktop, Lacerte, or Drake workloads on dedicated private servers, not shared ones. That means no “noisy neighbor” slowdowns when tax season hits and everyone else is pushing their systems to the limit.

VeritShield WISP turns compliance from a headache into a checkbox. Instead of scrambling to draft a Written Information Security Program for the FTC Safeguards Rule or IRS Publication 4557, firms get a structured, audit-ready framework baked in.

And for firms that want one throat to choke, VeritComplete blends hosting and IT management under a single roof.

Why Compliance Comes First

Firms are under pressure to prove security, not just practice it. Verito’s SOC 2 Type II certified infrastructure supports strong security controls that align with IRS 4557 and the FTC Safeguards Rule requirements, though SOC 2 certification itself measures operational security rather than direct regulatory compliance. Encryption, MFA, and fully isolated client environments make it easier to demonstrate controls during audits, insurer questionnaires, or client due diligence checks.

Tax Season Reliability

Every CPA knows January through April is a different game. Workloads spike 3–5×. Deadlines pile up. And downtime simply isn’t tolerated. Verito guarantees 100% uptime and scales server resources instantly during peak loads. In practical terms, that means your staff isn’t stuck waiting on lagging systems while tax returns stack up. Firms may need to request or provision additional capacity in advance for peak-season scaling, depending on their plan.

Accounting-Specific Edge

Generic MSSPs will keep endpoints safe, but they don’t understand why QuickBooks multi-user mode lags with the wrong server config, or how to tune large Lacerte databases. Verito does. It’s optimized for the accounting software suite, so firms don’t have to change how they work just to get secure. Explore more on QuickBooks hosting.

Support That Speaks Your Language

Many MSSPs promise 24/7 support. Few can answer a Drake Tax question at 10 PM. Verito’s help desk is staffed by engineers who specialize in accounting IT. That means a critical issue like setting up a secure remote office for seasonal staff can be handled within hours, not days. Clients often describe it as having a dedicated IT department without the payroll cost.

Best Fit

Verito is ideal for firms with 5–200 seats that need airtight compliance, predictable uptime, and industry-specific expertise. For firms that want to eliminate IT anxiety during tax season, it’s often the most cost-effective.

The Takeaway

Verito isn’t a “do-everything” MSSP. It’s a security partner built for accountants. If you want your systems to just work securely while meeting FTC and IRS requirements, Verito is the most accounting-focused option on this list.

2. Ace Cloud Hosting

Ace Cloud Hosting is one of the most recognized names in the accounting IT world, particularly among firms running QuickBooks in the cloud. Over the years, they’ve expanded from hosting to a broader managed IT + security offering, making them a common MSSP consideration for CPA firms.

What You Get with Ace Cloud Hosting

Managed IT and Security: Endpoint protection, multi-factor authentication, data encryption, and automated patch management are included as part of their managed service.

Cloud Hosting for Accounting Apps: Known for QuickBooks hosting, Ace also supports Sage, Drake, Lacerte, and other tax software. This makes them appealing to firms that want both application hosting and security from one vendor.

Disaster Recovery and Backups: Their solutions include routine backups, DRaaS (Disaster Recovery as a Service), and ransomware protection, which can be critical during busy seasons.

Compliance Coverage

Ace Cloud Hosting publishes documentation on SOC 2 controls and HIPAA alignment, though specific certifications can vary by data-center and plan. Firms should verify certifications before engagement. While not as boutique as Verito’s WISP-focused compliance services, Ace does give firms a baseline compliance-ready infrastructure with the ability to layer on additional controls.

Performance and Reliability

Ace is built for accounting workloads, so uptime and performance during tax season are a priority. Their infrastructure is scalable, allowing firms to expand server resources as staff count or database size grows. This is particularly valuable for mid-sized firms with 50–200 seats that want predictable performance without investing in on-prem servers.

Accounting-Specific Edge

Ace has been deeply embedded in the QuickBooks hosting space for years. For firms already on their platform, it’s often a natural step to expand into managed security services. That continuity—having one vendor host, secure, and support the software stack—is attractive for firms that don’t want to juggle multiple providers.

Support Experience

Ace offers 24/7 support, with technicians familiar with accounting applications. The difference here is scale: as one of the larger vendors, their support model may feel less personalized than smaller MSSPs. That said, the availability of accounting-trained support staff is still a differentiator compared to generic IT help desks.

Best Fit

Ace Cloud Hosting is a strong fit for firms in the 10–200 seat range who are already leveraging QuickBooks hosting or want a single provider for both cloud and security. It’s especially useful for firms with distributed teams who need consistent access and security across multiple offices.

The Takeaway

Ace is not the most specialized MSSP on this list, but it’s one of the most established in accounting IT. For firms that want a broad, all-in-one provider with proven cloud hosting and baseline compliance, Ace remains a solid contender.

3. Rightworks

Rightworks is another heavyweight in the accounting IT space, best known for hosting QuickBooks and tax applications. Over the years, they’ve evolved into a platform-plus-security provider, making them a natural MSSP option for larger accounting firms that want scale and integrations.

What You Get with Rightworks

Managed IT Security: Endpoint protection, advanced monitoring, data encryption, and disaster recovery built into their cloud platform.

Application Hosting: QuickBooks Desktop, CCH, Drake, and other tax applications are supported, making them a one-stop shop for hosting plus security.

Product Ecosystem: Beyond security, Rightworks offers add-ons like Office 365 integration, document management, and workflow tools, which can streamline firm operations alongside compliance.

Compliance Coverage

Rightworks supports SOC 2 compliance and aligns with IRS Publication 4557 requirements, giving firms confidence during audits or regulatory reviews. While they may not offer the same WISP development services as boutique vendors, their infrastructure is still designed to meet the Safeguards Rule and common CPA firm compliance needs.

Performance and Reliability

As one of the largest players in the accounting cloud space, Rightworks emphasizes uptime and scalability. Their infrastructure is designed for mid-sized to large firms, with the ability to support hundreds of users across multiple offices. During tax season, their scale is a benefit: firms rarely face bottlenecks in performance, even during peak filing weeks.

Accounting-Specific Edge

Rightworks has a long history with QuickBooks and accounting practice management software, which means integrations are smooth and workflows are preserved. Their strength lies in breadth—if your firm uses multiple accounting and tax applications and wants them all hosted, secured, and managed under one umbrella, Rightworks offers that at scale.

Support Experience

Support is 24/7 and accounting-aware, but as with most large providers, it can feel less personal compared to boutique MSSPs. For larger firms, though, the tradeoff is acceptable because of the stability, established processes, and extensive documentation Rightworks brings.

Best Fit

Rightworks is best suited for 50–200 seat firms that need enterprise-grade hosting and managed security combined with a broad IT ecosystem. Smaller firms may find the breadth unnecessary, while larger practices benefit from its ability to scale seamlessly.

The Takeaway

Rightworks is a big brand with big capabilities. For firms that value stability, integrations, and an established track record in the accounting industry, Rightworks provides a wide-reaching solution. While it may not have the boutique feel of a Verito, its scale makes it a reliable choice for firms with complex IT and security needs.

4. Tabush Group

Tabush Group is a New York–based IT provider with a clear niche: delivering cloud desktops and managed security for professional services firms, including accounting and law. Their flagship product, Boxtop, combines virtual desktops, hosting, and security into one integrated package.

What You Get with Tabush Group

Boxtop Cloud Desktop: Staff access their entire desktop environment securely from anywhere, making it easier to support hybrid and remote work setups.

Managed Security Stack: Includes MDR/EDR, phishing protection, multi-factor authentication, data encryption, and tested backups.

IT + Security Integration: Instead of bolting security onto existing infrastructure, Tabush designs both the cloud workspace and security controls together, reducing compatibility issues.

Compliance Coverage

Tabush builds environments designed to help firms meet IRS Publication 4557 and FTC Safeguards Rule requirements. While not an accounting-exclusive vendor, their compliance experience is rooted in professional services where data protection and confidentiality are non-negotiable.

Performance and Reliability

Because Boxtop delivers desktops as a service, firms don’t just move applications to the cloud—they move the full user environment. This eliminates local server dependencies and ensures consistent performance across offices or remote staff. During tax season, this centralization makes it easier to manage workloads and maintain uptime.

Accounting-Specific Edge

Tabush doesn’t market itself as narrowly as Verito or Rightworks, but many accounting firms choose them for the simplicity of an all-in-one desktop + security approach. For smaller to mid-sized firms that don’t want to manage servers, desktops, and apps separately, Tabush’s Boxtop solution streamlines everything.

Support Experience

Support is positioned as high-touch and proactive, with monitoring and 24/7 availability. Tabush highlights its ability to serve firms without dedicated IT teams, acting as a managed department rather than just a vendor.

Best Fit

Tabush Group is ideal for 25–150 seat firms that want to simplify IT infrastructure by adopting secure cloud desktops alongside managed security. It works especially well for firms shifting to hybrid work or consolidating multiple offices into one virtual environment.

The Takeaway

Tabush Group is less about piecemeal MSSP services and more about a bundled, cloud-first IT model with security at the core. For firms that see desktop management and cybersecurity as two sides of the same problem, Tabush offers a compelling “all-in-one” path forward.

5. Infodot IT Services

Infodot IT Services may not have the national brand recognition of Rightworks or Ace, but it has carved out a presence as a regional MSSP supporting small and mid-sized accounting practices. For firms that want affordable, practical managed IT security without the overhead of enterprise-scale vendors, Infodot is often on the shortlist.

What You Get with Infodot

Managed IT & Security Monitoring: Endpoint protection, anti-malware, patching, and 24/7 monitoring designed to protect accounting systems from ransomware and phishing attempts.

Data Backup & Recovery: Automated backups with restore testing, giving firms confidence that client files can be recovered if compromised.

Basic Compliance Support: Guidance to help firms align with IRS Publication 4557 and the FTC Safeguards Rule, though less comprehensive than boutique compliance-focused providers.

Compliance Coverage

Infodot provides entry-level compliance services that help firms check the boxes on federal requirements. While it may not deliver advanced WISP development or SOC 2 certification out-of-the-box, it does provide the foundational controls that small firms need to avoid regulatory pitfalls.

Performance and Reliability

Infodot emphasizes predictable IT performance and rapid support response. For firms under 50 seats, its infrastructure is usually sufficient, though larger firms with high transaction volumes or heavier database usage may find scalability limited compared to national players.

Accounting-Specific Edge

Infodot’s client base includes local CPA firms and small tax practices, which gives them direct experience with the workflows and seasonal challenges accounting professionals face. This makes them more relevant to small practices than generic regional IT providers.

Support Experience

One of Infodot’s strengths is availability: smaller firms often highlight how quickly issues are resolved. Instead of going through layers of escalation, clients usually work directly with a support engineer familiar with their environment.

Best Fit

Infodot is a solid fit for firms with 5–50 seats that need affordable managed security and IT support without enterprise overhead. It works best for practices that want baseline protection, backups, and monitoring, and are comfortable layering on additional compliance services as they grow.

The Takeaway

Infodot won’t replace the depth of compliance services offered by larger MSSPs, but for smaller accounting firms, it provides a budget-friendly, accounting-aware managed security option. It’s often the right step for firms upgrading from ad hoc IT support to a more structured, 24/7 security model.

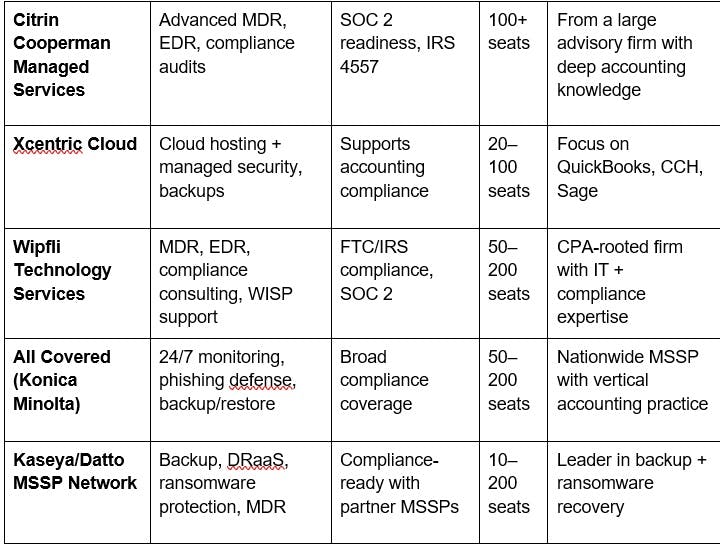

6. Citrin Cooperman Managed Services

Citrin Cooperman is not just another IT vendor—it’s one of the largest accounting and advisory firms in the U.S., with a dedicated managed services arm. This makes them uniquely positioned: they don’t just understand IT security, they understand the accounting profession from the inside out. For mid-to-large CPA firms, that combination is powerful.

What You Get with Citrin Cooperman

Advanced Security Stack: MDR/EDR coverage, intrusion detection, vulnerability management, and proactive threat intelligence.

Compliance Services: In-depth audits, gap analysis, and WISP development aligned with FTC Safeguards Rule, IRS Publication 4557, and SOC 2 frameworks.

Advisory Integration: As part of a major accounting firm, their managed services come with built-in knowledge of regulatory pressures, industry workflows, and client confidentiality standards.

Compliance Coverage

Citrin Cooperman offers end-to-end compliance services, including policy development, audit prep, and evidence gathering. Firms looking to prepare for peer reviews, insurer audits, or SEC/FTC inquiries find this especially valuable. Unlike smaller MSSPs, they act as both a managed provider and compliance consultant.

Performance and Reliability

With enterprise-scale infrastructure and resources, Citrin is designed for firms where downtime isn’t an option. Their security operations center (SOC) provides real-time monitoring, and their team is capable of handling large, distributed environments.

Accounting-Specific Edge

Few MSSPs can claim the same insider perspective: Citrin Cooperman is an accounting firm first. That means they’re fluent in the daily reality of CPA firms, from seasonal workload spikes to the reputational risks of a client data breach. This perspective informs how they prioritize security controls for accounting clients.

Support Experience

Support is layered and professional, with escalation paths across a large managed services team. While not as high-touch as boutique MSSPs, their scale ensures consistency, formal processes, and the ability to handle complex issues at depth.

Best Fit

Citrin Cooperman is best suited for 100+ seat accounting firms that want enterprise-grade managed security with compliance consulting baked in. For firms undergoing rapid growth, merger integration, or preparing for audits, their advisory + MSSP model is a strong fit.

The Takeaway

Citrin Cooperman isn’t the choice for smaller practices but for large CPA firms with complex compliance needs. They operate as accounting and advisory firms with dedicated managed-services divisions—hybrid models that combine IT and compliance consulting rather than pure-play MSSPs.

7. Xcentric Cloud

Xcentric Cloud has long been associated with accounting firms that want to modernize IT without abandoning the software they’ve relied on for decades. Their value lies in combining cloud hosting with managed security services, making them an attractive option for firms that want one partner to handle infrastructure and protection.

What You Get with Xcentric

Cloud Hosting for Accounting Apps: QuickBooks, Sage, CCH, Drake, and other practice software hosted in secure cloud environments.

Managed Security Suite: Endpoint protection, network monitoring, multifactor authentication, and regular patch management.

Backup & Recovery: Automated daily backups with restore testing, designed to ensure continuity during cyber incidents.

Compliance Coverage

Xcentric Cloud’s environments are built with IRS Publication 4557 and FTC Safeguards Rule compliance in mind. While they don’t emphasize compliance consulting at the same depth as larger MSSPs, they provide the technical safeguards most firms need to pass regulatory reviews.

Performance and Reliability

As a hosting-first provider, Xcentric prioritizes reliability and uptime for accounting workloads. This makes them especially appealing to firms with large QuickBooks or CCH databases that require consistent performance during peak season. Scalability is available, but the offering is more focused on stability and predictability than enterprise-grade customization.

Accounting-Specific Edge

Xcentric has a long history with CPA firms, which means its solutions are optimized for the quirks of accounting applications. Firms don’t have to worry about software incompatibility or generic IT teams unfamiliar with the industry—Xcentric is built for accountants.

Support Experience

Support is 24/7 with staff familiar with accounting software hosting. While not boutique-level, clients generally appreciate that support teams understand both the IT and application side of accounting workflows.

Best Fit

Xcentric Cloud is best for 20–100 seat firms that want to move their software into a secure, managed environment and reduce their reliance on local servers. It’s a middle ground between boutique vendors and large enterprise MSSPs.

The Takeaway

Xcentric Cloud is a strong option for firms ready to embrace the cloud without losing the accounting-specific support they’ve come to expect. If you want your applications hosted, secured, and managed by a provider that knows accounting software, Xcentric delivers a straightforward, reliable path forward.

8. Wipfli Technology Services

Wipfli is one of the largest CPA and advisory firms in the country, and their technology services division extends that expertise into IT and managed security. Unlike providers that simply “secure endpoints,” Wipfli positions itself as a compliance-first MSSP for regulated industries—accounting included.

What You Get with Wipfli

Managed Security Operations: MDR/EDR, 24/7 SOC monitoring, and phishing defense designed to detect and respond to attacks in real time.

Compliance Consulting: Deep expertise in FTC Safeguards Rule, IRS Publication 4557, SOC 2 readiness, and WISP development, making them a natural partner for firms preparing for audits or insurer reviews.

Cloud & IT Strategy: Beyond security, Wipfli helps accounting firms modernize their tech stack, integrate cloud applications, and plan IT budgets around compliance requirements.

Compliance Coverage

Where Wipfli stands out is in its regulatory fluency. As a CPA firm itself, Wipfli understands the scrutiny firms face—from safeguarding client data to satisfying insurer questionnaires. Their ability to tie technical security controls directly to compliance frameworks gives them an edge over traditional MSSPs.

Performance and Reliability

With enterprise-grade infrastructure and a dedicated SOC, Wipfli offers reliable uptime and proactive defense. Their model is geared toward mid-sized to large firms, ensuring scalability for distributed offices and remote staff during tax season.

Accounting-Specific Edge

Wipfli’s credibility comes from being a CPA-rooted firm with IT expertise. This dual identity resonates with accounting practices that want more than technical security—they want a provider who understands professional standards, regulatory risk, and the reputational stakes of a data breach.

Support Experience

Wipfli offers structured, enterprise-level support with clear escalation paths. While less “personal” than boutique providers, their scale ensures coverage, process maturity, and access to a broad team of specialists.

Best Fit

Wipfli is ideal for 50–200 seat firms that face significant regulatory pressure or want an MSSP that doubles as a compliance advisor. Firms with complex structures (multi-office, multi-state) will find Wipfli especially well-suited.

The Takeaway

For firms where compliance is as critical as security, Wipfli brings big-firm assurance with industry expertise. They aren’t the lightest or cheapest solution, but they deliver confidence that your security program will stand up to regulators, clients, and insurers alike.

9. All Covered (Konica Minolta)

All Covered, the IT services arm of Konica Minolta, is one of the largest MSSPs serving small and mid-sized businesses across industries. While not accounting-exclusive, they have a dedicated vertical practice for CPA firms, making them a frequent consideration for multi-office practices that need nationwide coverage.

What You Get with All Covered

Managed Security Operations: Endpoint protection, SOC monitoring, phishing defense with training, and ransomware protection.

Data Backup & Disaster Recovery: Cloud-based backup solutions with rapid restore capabilities, reducing downtime risks.

IT & Cloud Services: Infrastructure management, Microsoft 365 integration, and virtual CIO (vCIO) advisory services for long-term IT planning.

Compliance Coverage

All Covered environments are built to align with FTC Safeguards Rule and IRS Publication 4557. While they may not offer boutique WISP development, they do provide the core technical safeguards and compliance documentation most CPA firms require during audits or insurer assessments.

Performance and Reliability

As a nationwide MSSP, All Covered has the resources and infrastructure to deliver consistent uptime and performance across distributed firms. Their scale makes them a reliable option for practices with multiple offices or remote teams.

Accounting-Specific Edge

Although not boutique, All Covered has a dedicated accounting practice that focuses on tax season uptime, secure remote access, and application support for QuickBooks and other common CPA firm tools. For firms that want a big brand with accounting awareness, this vertical offering adds credibility.

Support Experience

With a 24/7 national help desk, All Covered offers breadth of coverage and mature escalation processes. Firms benefit from consistency and availability, though support may feel less personalized compared to boutique or regional MSSPs.

Best Fit

All Covered is best for 50–200 seat accounting firms that want a national-scale MSSP with broad service capabilities. It’s particularly appealing for firms with multiple offices or those seeking an IT partner that can also guide long-term strategy.

The Takeaway

All Covered is about scale and reach. For firms that want the reassurance of a national MSSP with accounting-specific practice expertise, it delivers comprehensive security and IT support—though at the cost of boutique personalization.

10. Kaseya / Datto MSSP Network

Kaseya and Datto don’t market directly to CPA firms the way boutique MSSPs do. Instead, they power a vast network of local and regional MSSPs that deliver managed IT and security services using Kaseya’s technology stack. For accounting firms evaluating providers, it’s common to find Kaseya/Datto tools running in the background—even if the firm’s contract is with a smaller IT company.

What You Get with Kaseya/Datto

Backup & Disaster Recovery: Datto is a recognized leader in ransomware protection and instant restore. For firms worried about data loss during peak season, this is often the most critical feature.

MDR/EDR & Monitoring: Through partner MSSPs, firms gain endpoint protection, real-time monitoring, and patch automation powered by Kaseya.

RMM (Remote Monitoring & Management): Tools that give MSSPs visibility into endpoints, networks, and servers—helping them respond quickly to threats.

Compliance Coverage

Kaseya and Datto’s software stack provides technical controls (MDR/EDR, backup, monitoring) that can help MSSP partners meet FTC Safeguards Rule and IRS 4557 expectations, though compliance implementation rests with the partner, not Kaseya itself.

Performance and Reliability

Datto’s reputation in business continuity and rapid recovery is its strongest asset. CPA firms dealing with ransomware or accidental data loss can often restore systems within minutes, reducing downtime during tax season. Performance depends on the local MSSP partner, but the underlying tools are built for resilience.

Accounting-Specific Edge

The edge here is indirect. While Kaseya/Datto isn’t accounting-exclusive, many MSSPs in their network specialize in serving CPA firms. For small to mid-sized practices that want strong ransomware defense paired with local IT relationships, this model works well.

Support Experience

Support is provided by the partner MSSP, not Kaseya/Datto directly. This means the experience varies: some firms report highly personalized service from local providers, while others note inconsistencies depending on the partner’s size and expertise.

Best Fit

Kaseya/Datto-powered MSSPs are a good fit for 10–200 seat firms that prioritize backup, recovery, and ransomware resilience. They’re especially suited for firms that want to work with a local IT partner but still leverage enterprise-grade tools.

The Takeaway

Kaseya and Datto represent the backbone of many smaller MSSPs, providing the technology for ransomware protection and business continuity. For accounting firms, the key is vetting the local partner delivering these services—since the tools are excellent, but the service quality depends on who’s managing them.

Conclusion

For accounting and tax firms, cybersecurity is no longer a background IT concern—it’s a boardroom priority. Between the FTC Safeguards Rule, IRS Publication 4557, and rising ransomware threats, firms can’t afford to gamble on generic IT vendors or piecemeal tools. A managed security service provider (MSSP) offers the structured, 24/7 protection that ensures client trust and regulatory compliance.

The ten providers in this guide represent the most relevant options for CPA firms of different sizes and maturity levels.

Verito stands out for its accounting-first approach, purpose-built stack, and peak-season reliability.

Ace Cloud Hosting and Rightworks offer broad hosting + security ecosystems for firms that want an all-in-one provider.

Tabush Group simplifies IT with secure cloud desktops.

Infodot IT Services provides an affordable entry point for smaller firms.

Citrin Cooperman and Wipfli bring enterprise-level compliance and security expertise rooted in accounting DNA.

All Covered delivers national-scale coverage with a dedicated CPA practice.

Kaseya/Datto powers many local MSSPs, giving firms strong ransomware resilience through trusted partners.

Most listed providers offer 24/7 monitoring or response capabilities, though coverage levels vary. Some regional vendors provide on-call or outsourced after-hours support instead of a full in-house SOC. And remember: for CPA firms, the three must-have controls are MDR/EDR, phishing defense with training, and tested backups with rapid restore.

Ultimately, the “right” MSSP depends on your firm’s size, regulatory profile, and tolerance for risk. Smaller practices may lean toward regional or boutique partners, while larger firms benefit from enterprise-level compliance consulting and multi-office scalability.

The takeaway is simple: security is now part of the cost of doing business in accounting. The difference between firms that thrive and those that falter often comes down to whether IT is a speed bump—or a secure, invisible backbone that just works.

FAQs

1. What is a managed IT security service provider (MSSP) for accounting firms?

An MSSP for accounting firms is a third-party provider that delivers 24/7 monitoring, endpoint protection (MDR/EDR), phishing defense, data backups, and compliance support. Unlike generic IT vendors, accounting-focused MSSPs understand IRS Publication 4557, FTC Safeguards Rule requirements, and the uptime demands of tax season.

2. Which MSSP features are most important for CPA firms?

The three must-have controls for CPA firms are MDR/EDR for endpoints, phishing defense with staff training, and tested backups with rapid restore. Together, these form the foundation for ransomware protection, compliance, and business continuity.

3. How do MSSPs help with IRS Publication 4557 and the FTC Safeguards Rule?

MSSPs implement technical controls like encryption, multifactor authentication, monitoring, and access logs. Many also provide WISP (Written Information Security Program) support, which is required under both IRS and FTC guidelines for data protection.

4. How much does managed security typically cost for a CPA firm?

Pricing varies by provider and firm size. A small 10-seat firm might spend under $2,000 per month, while a 100+ seat firm may invest significantly more for enterprise-grade compliance and monitoring. Most MSSPs charge on a per-user or per-endpoint basis.

5. Should a small tax practice hire an MSSP, or can it manage security in-house?

Even small firms face the same regulatory requirements as larger ones. For practices without dedicated IT staff, an MSSP is often more cost-effective than trying to build in-house capabilities—especially since MSSPs provide 24/7 monitoring and incident response that a single IT person cannot.

6. What makes accounting-focused MSSPs different from general providers?

Accounting-focused MSSPs specialize in the software stack (QuickBooks, Drake, Lacerte, Sage, CCH), know the seasonal workload spikes, and tailor compliance services to IRS/FTC requirements. Generic providers may secure systems, but they often lack accounting-specific expertise.

7. How do I choose the right MSSP for my accounting firm?

Follow a three-step process:

Map regulatory requirements (FTC Safeguards, IRS 4557, SOC 2 readiness).

Confirm the provider offers MDR/EDR, phishing defense, and tested backups.

Stress-test support responsiveness and uptime during tax season.